Energy stocks remain cheap despite oil price strength

The higher spot oil price has yet to be fully factored into share prices, writes Mark Taylor.

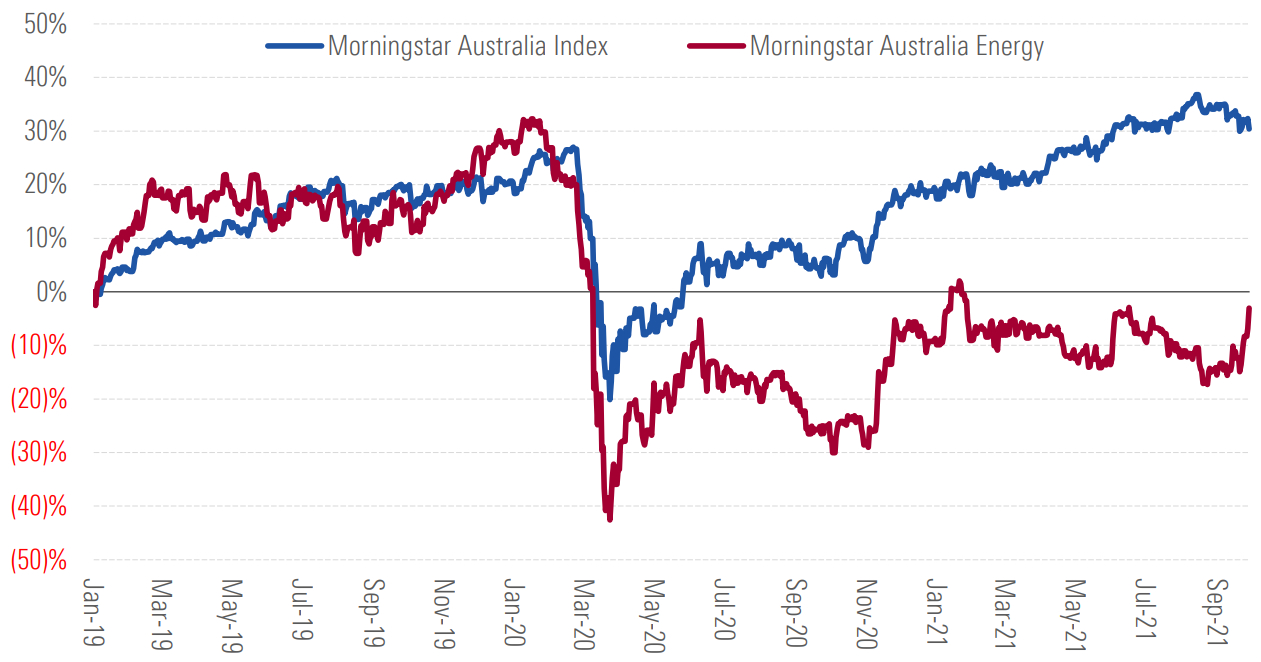

Energy stocks have been in a holding pattern over the past three quarters. The Morningstar Energy Index has traded in an approximate plus/minus 10% range. This contrasts to the dramatic 55% plunge in the first quarter of 2020 with the onset of Covid-19 lockdowns, followed by a 25% jump in the fourth quarter as oil prices staged a recovery.

Brent crude traded in an approximate US$65–US$75 per barrel band in the third quarter of 2021, a far cry from sub-US$20 per barrel levels plumbed in the second quarter of 2020. But focus should really be on the Asia LNG spot price which hovers at a staggering US$27 per mmBtu as we write, a 13-fold rise on US$2 per mmBtu lows of May 2020.

Australian exploration and production (E&P) companies dominate the Energy index. Woodside and Santos alone comprise approximately 40% of the index. Woodside shares rose 8% in third-quarter 2021 with Santos flat. It’s hard to fathom what the market is thinking. There is a bizarre disconnect between energy prices and energy stock share prices. The market appears to be taking the current spate of merger proposals as a sign of sector weakness. Santos is to merge with Oil Search, Woodside with BHP Petroleum, and Ampol with Z Energy, which will make for even stronger companies.

Energy Stocks traded in a holding pattern during the third quarter of 2021

Source: Morningstar data and estimates

The average Brent crude price in 2020 was US$42 per barrel but the average for the first three quarters of 2021 is over US$67 per barrel, and the price currently exceeds US$76.00 per barrel. With the LNG contract referenced to crude with a one-quarter lag, we have been writing about the favourable pricing essentially already locked-in for E&P companies this year.

Last year’s LNG contract came in at an approximate US$6.50 per mmBtu. This year’s will confidently be US$8.60 per mmBtu, still capturing the tail end of weak fourth-quarter 2020 Brent prices, but also capturing an average fourth-quarter 2021 LNG contract in the vicinity of US$10.20 per mmBtu.

Woodside Petroleum (WPL)

No-moat Woodside Petroleum is trading at a near-36% discount to our $40 fair value and is 5-star-rated. We think the shares still unwisely underpriced for growth potential. We credit commissioning of the second Pluto train from 2025, adding over 38mmboe in annual equity production, a 38% increment on 2020’s 101mmboe group output. Plans have recently been given a boost with the proposed merger with BHP Petroleum. In terms of common ground, BHP has a one-sixth stake in the North West Shelf, a 26.5% interest in Scarborough gas, and 17.3% stake in Browse gas for starters. Greater control to Woodside is advantageous. BHP’s assets overall will be coming largely unencumbered which means operating cash flows will support Scarborough and Pluto T2developments.

Beach Energy (BPT)

No-moat Beach Energy is trading at a 41% discount to our $2.50 fair value and is 5-star-rated. Might the midsize Australian oil and gas producer, and Australia’s largest domestic oil producer, become the next target on the merger and acquisition ledger? Kerry Stokes’ Seven Group already has a 30% stake. Our stand-alone fair value estimate equates to a fiscal 2026 EV/EBITDA exit multiple of 4.0, after stripping out $300 million lump-sum for the Beharra Springs Deep and other discoveries. We assume a healthy five-year EBITDA CAGR of 11.5% to USD 1.3 billion by fiscal 2026. We forecast group output reaching 45mmboeby fiscal 2027, including Stage 2 expansion of Waitsia gas output and Otway gas wells.

Santos (STO)

No-moat Santos is trading at a 23% discount to our $9.70 fair value and is 4-star rated. The boards of Santos and Oil Search recently agreed merger terms to create a company with production in the vicinity of 120mmboe growing to 180mmboe late this decade. We forecast a healthy 10-year fully diluted EPS CAGR for the merged Santos of 18.3%, from 2020 COVID-19 lows of $0.20 to $1.09 by 2030.

This is a snippet from Morningstar analyst's Australia and New Zealand Equity Market Outlook Q4 2021. Morningstar Premium subscribers can access the full report here.