These 3 ASX companies share something powerful with Uber

Situations like this are rare and can lead to impressive growth and daunting moats.

Mentioned: Uber Technologies Inc (UBER), ASX Ltd (ASX), REA Group Ltd (REA), WiseTech Global Ltd (WTC)

I'm not proud of it, but I recently booked an Uber ride, takeout and grocery delivery in a single day. Scoring the lazy man's hat-trick made me realise that Uber (NYS:UBER) has become a tollbooth on modern urban life. Multiply this by billions of city dwellers, and that sounds like a valuable position to find yourself in.

But how did Uber find itself there? A lot of it comes down to network effects.

What is a network effect?

A network effect arises when a product or service becomes more and more valuable with every member that is added to it. This can eventually result in a moat for the company operating the product or service. It becomes either very hard or very expensive for new entrants to replicate that value from scratch.

Social media is often used as an example. The more users a social media site has, the more people you have to follow and the more content there is to consume. A new competitor to Instagram would start without any of this content and without any of your friends or family as users. What are the chances you would sign up to a new photo sharing service instead of Instagram?

Uber’s ride-hailing network effect

Uber’s ride-hailing network comprises drivers and riders. Every new driver that joins Uber adds value to riders because there will be more cars available, shorter wait times and lower prices. Meanwhile, every new rider adds value to drivers because it’s one more potential job for them to pick up. But it doesn’t end there.

Every new Uber driver also adds value for other drivers - more cars and shorter wait times attract more riders, which means more jobs. Likewise, new riders add value for other riders - more jobs attract more drivers, which results in shorter wait times. It’s a virtuous cycle that keeps attracting riders and drivers to Uber.

Once it reaches a critical mass, the value of the network itself becomes the main driver of growth and incremental revenue can be generated at little extra cost.

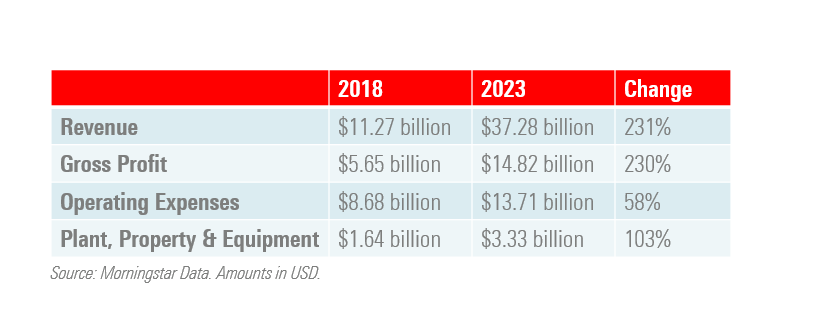

Look at the acceleration in Uber's gross profit between 2018 and 2023 compared to the growth in operating expenses and PPE. The data below also includes UberEats and delivery, where Uber has tried to leverage its success in ride-hailing into new network effect businesses.

Network effect end games

The dream outcome for a network effect business is that they end up as the only game in town. At that point, the business just needs to spend enough to maintain the network and find more ways to profit from their position. This could involve improving the product using data generated by the network itself – data that new entrants wouldn’t have – or by selling access to that data.

Many of the most famous network effect businesses like Uber, Facebook and eBay have their roots in the US. But our analysts think that several Australian companies benefit from them too. Here are three very different examples.

ASX (ASX:ASX)

ASX is Australia’s leading provider of equity listings, settlement, clearing and trading. It has an effective monopoly on equity listings in Australia with over 95% market share. ASX’s catchment zone also extends to New Zealand, with New Zealand based companies cross listing on the ASX equating to around a third of total companies listed on the New Zealand Stock Exchange.

Established financial exchanges are among the purest examples of network effect businesses. Here is what Morningstar analyst Roy Van Keulen has to say about network effects in ASX’s clearing business:

“As the number of trades, participants and products that go through a clearing house increases, collateral requirements decrease correspondingly due to more collateral being netted out across the house. This creates strong network effects as lower trading costs attracts additional participants and products, thereby lowering these costs further, in a positive feedback loop.”

And its trading business:

“The strongest moats we see in exchange trading businesses come from the creation of markets for unique and globally relevant derivatives based on underlying assets which previously had prohibitively low market liquidity. Once sufficient volumes have been attracted to the market, liquidity tightens, and indirect trading costs based on bid-ask spreads decrease.

When this is achieved, a tipping point can be reached whereby additional market participants and volumes are attracted to the market, which further tightens liquidity and further decreases indirect trading costs, creating a positive feedback loop and strong network effects.”

ASX also monetizes the data generated on its exchanges:

“Given that most trading takes place on exchanges rather than over the counter, exchanges have proprietary data on the pricing of securities. By selling access to this data to market participants and offering co-location hosting services near the exchange itself, exchanges have additional avenues of monetizing trading activity that competitors don’t have. We see this most frequently leading to high margin data businesses.”

REA Group (ASX:REA)

REA Group operates the largest residential real estate listings platform in Australia. Here are Van Keulen’s thoughts on network effects in the online listings business:

“Online listings platforms derive their network effects from a virtuous cycle of additional demand on the network attracting additional supply and vice versa, at little incremental expense to the platform operator. In the case of real estate listings platforms, the value of the network increases for prospective listers commensurate with the size of the audience, while for the audience the value of the network increases commensurate with the size of the pool of listings.

Network effects can be incredibly costly to establish in listings platforms as they require a critical scale on both the supply and demand side of the network. Only after a certain audience size and listings pool size has been achieved does one side of the network start attracting the other and vice versa.”

REA Group managed to establish a network effect thanks to its first mover advantage. With the backing of majority-owner News Corp, it created and popularised the first online listings platform for real estate in Australia, thereby becoming the primary beneficiary from the secular shift of print advertising toward online.

This has helped REA Group achieve significantly better economics than its competition:

“REA Group’s core website, www.realestate.com.au has a comparable number of listings as competitor www.domain.com.au and their respective mobile apps also have a comparable number of downloads. However, www.realestate.com.au attracts around three times as much traffic as www.domain.com.au and charges around three times as much in revenue per listing.”

WiseTech Global (ASX:WTC)

WiseTech’s software and technology helps logistics firms digitize their operations. WiseTech’s core product suite, CargoWise, is a software solution for international freight-forwarding by air and ocean. Here is why Van Keulen thinks CargoWise benefits from network effects:

“When operators of ships, airplanes, trains, trucks, and warehouses are integrated with CargoWise, freight-forwarders can see goods move along the supply chain without having to manually track and trace these movements. This results in significant labor cost savings for freight-forwarders.

“Given the cost-focused nature of the logistics industry, we believe this incentivizes freight-forwarders to select asset operators that are integrated with the CargoWise platform. Hence, asset operators are incentivized to integrate with CargoWise to win business.

This in turn increases the pool of potential asset operators that freight-forwarders can work with in a highly efficient manner, thus creating a network effect.”

Not the only moat in town

Network effects are one five major moat sources identified in Morningstar’s equity research process. To learn about other sources of durable competitive advantage, I recommend my colleague Mark Lamonica’s article how to find great companies to buy.