Morningstar Investor

Discover new investments, track & analyse your portfolio, and navigate market shifts. Sign up for a FREE 4-week trial^ now.

The ideal companion for your investing journey

Independent research and data

We offer independent research and data on over 48,000 securities. We are independent, which means we do not charge or accept payment or commissions from fund managers, listed companies or other product issuers to produce research on their products.

Market Insights and Monitoring Tools

Access market leading, uniquely independent investment insights from our editorial team, and access daily updates on market movements.

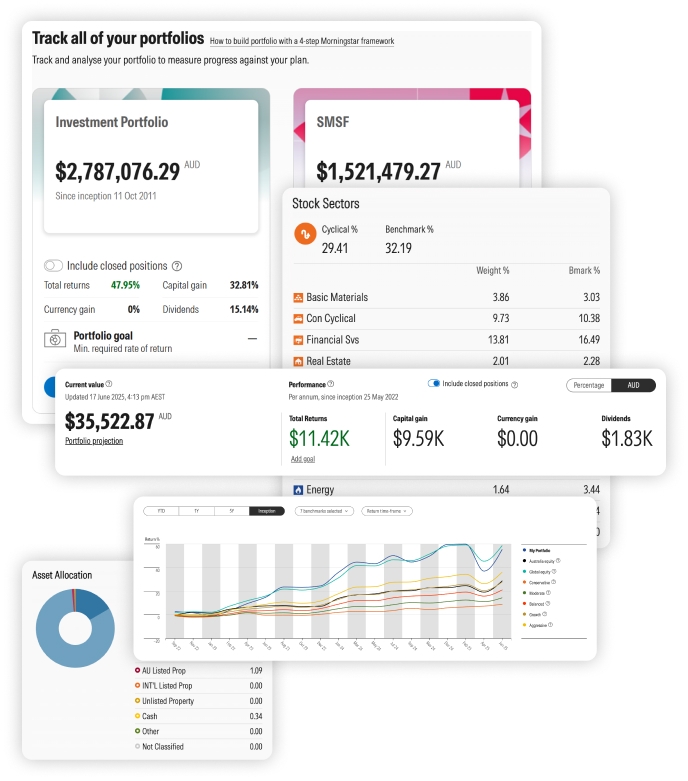

Build, Monitor and Maintain Your Portfolio

The Morningstar Investor Portfolio Manager is integrated with the Sharesight Standard Plan. We believe in focusing on the investor, before the investment - build a portfolio with tools such as our goal setting calculators, asset allocation guidance and investment filters. Easily monitor portfolio progress and performance, with a full suite of performance and attribution reports.

Ready to see for yourself?

No credit card needed

Why choose Morningstar Investor?

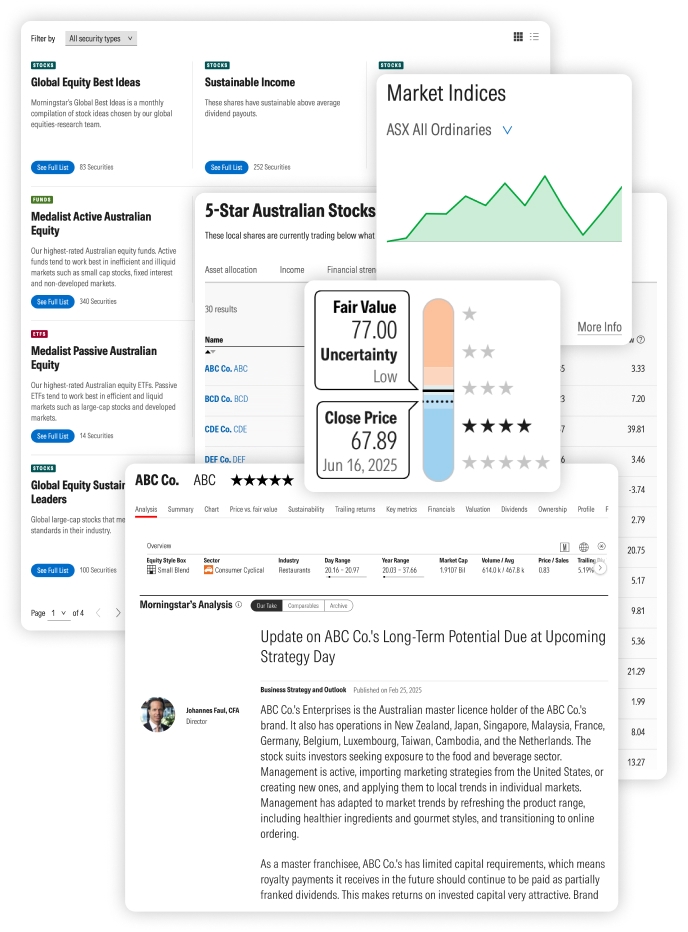

Discover investments

Find investment opportunities which fit your needs with our equities, ETFs, Funds and Hybrids coverage.

- Access qualitative analyst research on more than 1,600 stocks, forward-looking ratings on over 3,000 ETFs and managed funds, plus data on over 48,000 global securities

- Access our top equity picks, including sustainable dividend generating stocks, 5-star Australian and global stocks, 5-star Australian and global listed property stocks, sustainable investing stocks and more

- Easy-to-use, customisable filters to quickly identify investments which suit your goals

- Stock filter options include sector, market cap, dividend yield, franking percentage, payout ratio, Morningstar rating, economic moat, price/earnings ratio, return on equity, annualised return and more

- ETF and Fund filter options include yield, total cost ratio, annualised return, category, management style, Morningstar analyst rating, sustainability rating and more

- Keep an eye on price movements and Morningstar ratings as you wait for a more compelling opportunity with a customisable watchlist

Track & analyse investments

Morningstar Investor includes complimentary access to Sharesight’s Standard Plan, one of Australia’s leading portfolio trackers (valued up to $464.04 p.a.)

Sharesight’s integration into Morningstar Investor’s portfolio manager allows you to:

- Track all of your investments in a single location

- Easy dividend tracking with corporate actions automatically incorporated in portfolio reports

- An integration with Morningstar’s data and research: garner insights on your holdings from our team of equity and fund analysts

- Know your portfolio's true performance with daily price & currency updates

- Save time during tax time with streamline portfolio and tax reporting

- Know your exposure: Take a deep dive into your portfolio with Morningstar’s Portfolio X-Ray – get region, sector and style breakdowns

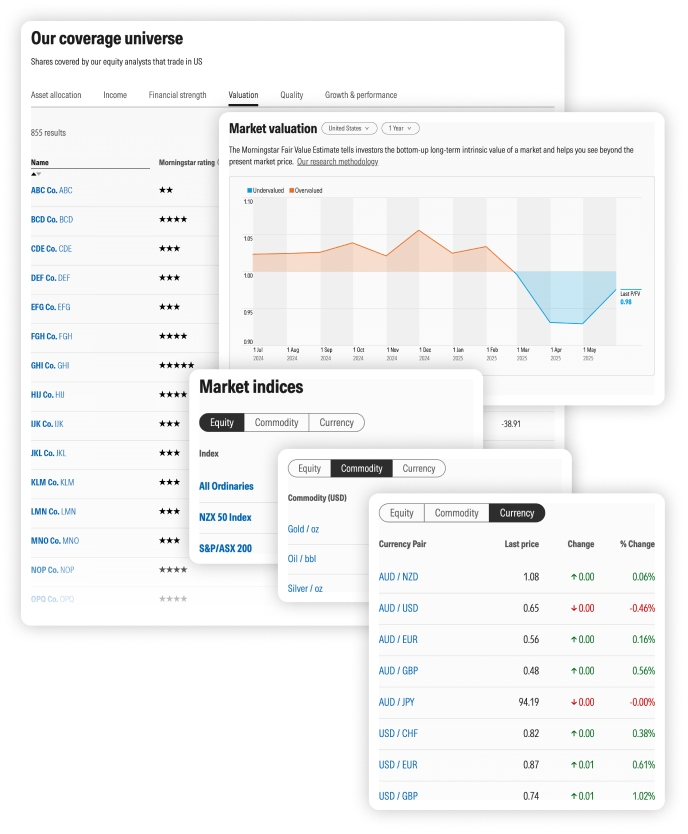

Monitor markets

We contextualise day to day market movements with our view of the overall market valuation so you can focus on the long-term investment opportunity.

- Explore index, commodity and currency changes

- See the current price to fair value of each market we cover along with the valuation from a year ago

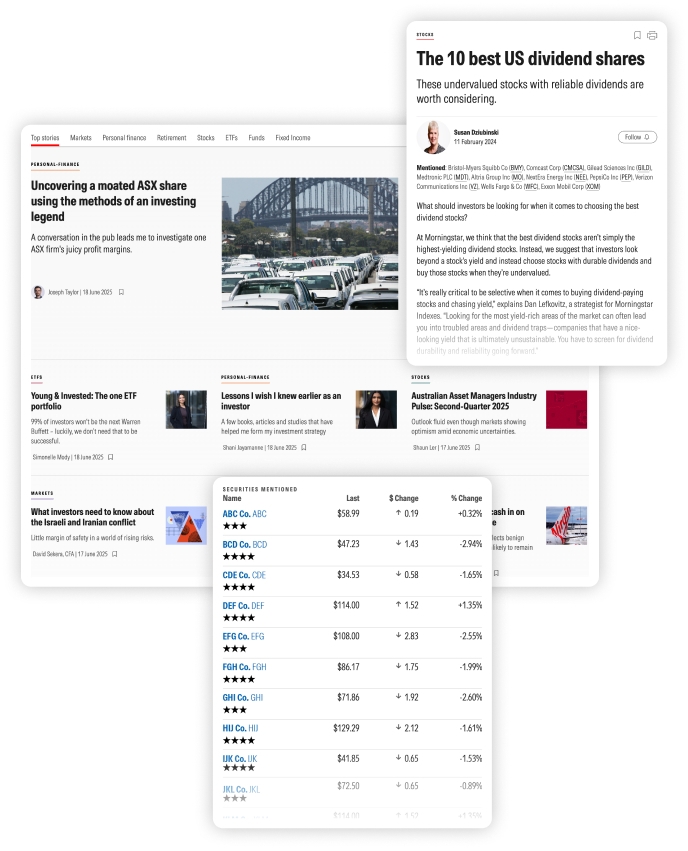

Stay informed

Our teams in Australia, North America and Europe deliver insights from our wide breadth of equity, fund and ETF research, our in-house behavioural science researchers and our investment management team.

- A view on markets and investing focused on sound analysis rather than snap reactions to market events

- Commentary and insights on latest economic, political and business news

- Access to our latest equity, fund and ETF research, including in-depth research reports

Learn to invest

Knowledge is the foundation of independence. Access to educational webinars and investing guides covering a wide range of topics. These are designed for both novice investors and experienced investors looking to review key foundational topics.

- Discover strategies to build wealth via stock, fund and ETF investing

- Learn fundamental frameworks for successful long-term investing

- How to build a portfolio aligned to your goals

Ready to see for yourself?

No credit card needed

Frequently Asked Questions

➣ Why does Morningstar’s ratings on my broker platform differ from the ones in Morningstar Investor

The research that you receive through your Morningstar Investor Membership is qualitative—our analysts have rated the stock and provided input and opinion to the final fair value. The research that you access through your broker is quantitative in nature – what this means is that the fair value is decided based on data inputs and algorithms, without weigh in from our analysts.

This is why the research and ratings may differ between your membership and your broker.

Morningstar Investor is not a broker service – it offers a different service to your broker – focusing on providing investors a holistic portfolio management tool that helps you track, monitor and maintain your investments.

➣ I receive Morningstar ratings for free from my broker. How is this product different? What is the difference if I access it directly?

The level of access to Morningstar ratings and data differs broker to broker, but in most instances, the ratings that you receive free from your broker are quantitative in nature. This means that fair value (the long-term intrinsic value of a share) that is assigned to a share is calculated based on an algorithm. As part of Morningstar Investor, you receive access to qualitative analyst research on more than 1600 stocks, forward-looking ratings on over 3,000 ETFs and managed funds.

Morningstar Investor is a holistic solution that is focused on the investor, and not the investment. It offers access to ratings, as mentioned, and data on over 48,000 securities. It also includes analyst insights and editorial thought leadership, including forecasts for ASX 200 stocks.

As part of your subscription, you also receive access to a Portfolio Manager that is powered by award winning Portfolio Tracker, Sharesight and integrated with Morningstar research and data. This is accompanied by a suite of tools and calculators to help investors reach their investing goals, including goal calculators, asset allocation models, ETF model portfolios and more.

➣ What if I already have Sharesight subscription?

If you already have a Sharesight subscription, we will pick up your bill (up to the value of the Standard Plan). For existing Sharesight subscribers, you are able to link your existing account to your Investor subscription. If you are on the monthly Standard plan, the billing will be directed to Morningstar from the following month. If you are on an annual plan, the next annual payment will be paid directly by Morningstar. If you are on a higher priced plan you will be charged the difference between the Standard plan cost and your plan.

^The free 4-week trial offer is limited to new clients and cannot be used to extend an existing Investor Membership. One free trial per household. Morningstar is licensed to provide our subscription service to Australian residents only.