How fixed income fund managers navigate rising rates

Further interest rate increases from central banks could be destabilising for fixed income managers, but most are positioned for this, as explained in Morningstar's March edition of Australian Fixed Interest Sector Wrap.

Further interest rate increases from central banks could be destabilising for fixed income managers, but most are positioned for this, as explained in Morningstar's March edition of Australian Fixed Interest Sector Wrap.

Investors often assume duration--a concept referring to the sensitivity of interest rates to upward or downward movement in bond yields--is the only lever a bond manager has to handle rising interest-rate environments. Instead, strategies such as credit, inflation-linked securities, currency, and curve positioning can benefit from rising rates.

Duration

Adopting an underweight or short duration strategy is a logical strategy for managers to combat rising weights. This typically reduces the strategy's potential diversification, and usually reduces yield--a critical requirement of investors.

As most core strategies are benchmarked to an index, they will always have a base level of embedded duration and, hence, will always be sensitive to changes in bond yields. Allowable duration bands across strategies are all different, and in our opinion the level of flexibility should be a consideration when investors decide where to allocate. That said, while duration management is critical to return outcomes, it is notoriously difficult to sustainably predict.

Curve

A lesser understood strategy available to managers is to allocate different maturities along rates curves, to speculate on the changes in its shape.

A yield-curve-steepening strategy is implemented when managers believe the long end of yield curves will sell off relative to the shorter maturities. Incidentally, this is the strategy most managers implement in a rising-rate environment as increases in short-term interest rates (due to economic growth and inflation) will usually have a knock-on effect (upward repricing if not already priced in) further along the curve. This strategy is implemented by underweighting (relative to the benchmark exposure) or shorting (absolute) a 10- or 30-year bond while overweighting/going long shorter-maturity bonds.

A yield-curve flattener is a strategy that is more popular in environments where there is an assumption of lowering interest rates. It is a mirror image of the steepener strategy, which means a manager will buy more 10- and 30-year maturity bonds while underweighting the shorter-term maturity.

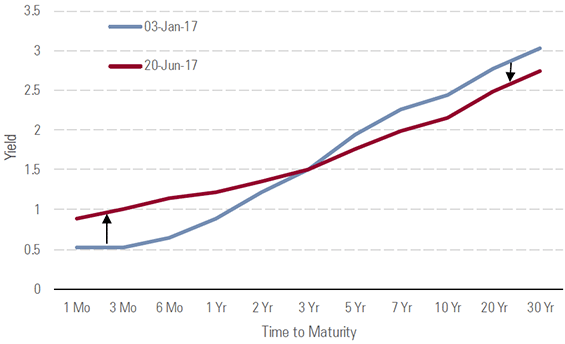

Exhibit 1 Flattening US Treasury Yield Curve, January 2017 to June 2017

Source: US Department of the Treasury

The manager is taking advantage of the multiplier effect of the longer duration to get the best payoff from a low growth, low inflation, reducing-rate environment. Exhibit 1 is an example of the US Treasury yield-curve flattening between January 2017 to June 2017.

Critically, a manager can implement these strategies without materially changing the overall duration of the fund. Furthermore, managers with a global mandate can take advantage of the shape of overseas yield curves.

Inflation-linked bonds

These are securities that expose investors to real changes in interest rates as principal and interest payments rise and fall with the rate of inflation. This serves as protection for investors from the primary reason why interest rates increase: inflation.

Practically, the use of inflation-linked securities is a compelling tool in rising interest rates, as the capital will adjust upwards as inflation rises.

While this seems like a perfect instrument to hold in rising-rate environments, there are some drawbacks. These securities have significant duration embedded within them, which can be hedged if the manager wishes--they are not as liquid as nominal bonds, and they can trade at unattractive prices.

Credit

Floating-rate credit is a well-known strategy for managers to implement in rising interest-rate environments. Floating-rate securities are issued at a spread above either 10-year bonds or the short-term cash index, such as bank bills or LIBOR.

This spread means that if cash rates or 10-year yields increase, the absolute level of income from the credit will also appreciate by the spread amount. This lock step between rates and income is a key reason why these instruments are highly popular with bond managers in a low-yield/appreciating interest-rate world to satisfy investors’ thirst for income to meet their own liabilities.

An important and related concept is spread duration. This measures a corporate bond’s sensitivity to changes in credit spreads. A combination of yield and maturity is the key determinant in the spreadduration calculation. The higher the credit spread duration number a manager exhibits, the higher the portfolio’s sensitivity to upside and downside from movements in credit markets.

While credit is a popular tool, managers must be careful, as too much allocation to credit can significantly increase the riskiness of the portfolio in a risk-off market environment.

Currency

We are increasingly seeing currency allocations form a higher component of bond funds. Currencies can be held in different magnitudes in many bond managers' mandates. Put simply, there is often a positive relationship between increasing cash rates and strengthening currency. Because of this relationship, managers have a choice in implementing a view on rising rates by either underweighting duration or overweighting currency.

Increasingly, managers are implementing views through currency rather than duration / rates because of the holding costs. Being short duration can cost money (negative carry), while a well-structured currency pair can be accretive (positive carry).

The volatility of currency is much higher than that of bonds--which means it can be a double-edged sword for return outcomes for managers. It’s notable that global managers have more levers to pull than pure domestic funds, given the larger universe of assets and countries.

Logically, the local market does not give managers the largest investment universe; an example of this is the local index, which does not have any exposure in high yield, compared with what is available in the Barclays Global Aggregate.

Indeed, we have seen a larger number of domestic-benchmarked managers increasing allocations to global assets--managers such as Colonial First State and Henderson joining the likes of PIMCO and BT in having a global allocation.

More from Morningstar

• Make better investment decisions with Morningstar Premium | Free 4-week trial

Kunal Kotwal is a senior analyst in the manager research team at Morningstar.

© 2018 Morningstar, Inc. All rights reserved. Neither Morningstar, its affiliates, nor the content providers guarantee the data or content contained herein to be accurate, complete or timely nor will they have any liability for its use or distribution. This information is to be used for personal, non-commercial purposes only. No reproduction is permitted without the prior written consent of Morningstar. Any general advice or 'class service' have been prepared by Morningstar Australasia Pty Ltd (ABN: 95 090 665 544, AFSL: 240892), or its Authorised Representatives, and/or Morningstar Research Ltd, subsidiaries of Morningstar, Inc, without reference to your objectives, financial situation or needs. Please refer to our Financial Services Guide (FSG) for more information at www.morningstar.com.au/s/fsg.pdf. Our publications, ratings and products should be viewed as an additional investment resource, not as your sole source of information. Past performance does not necessarily indicate a financial product's future performance. To obtain advice tailored to your situation, contact a licensed financial adviser. Some material is copyright and published under licence from ASX Operations Pty Ltd ACN 004 523 782 ("ASXO"). The article is current as at date of publication.