Morningstar runs the numbers

We take a numerical look through this week's Morningstar research. Plus, our most popular articles and videos for the week ended 6 August.

$176 million

After a disappointing IPO, retail investors piled into Robinhood, exchanging 176 million shares in an option-fuelled frenzy, writes Emma Rapaport in the Editor’s Note: “A wave of individual investors decided to get in on the action after the first public day of trading, sending the company's market value to a peak of US$65 billion - to the moon, in meme parlance. A whopping 176 million shares changed hands on Wednesday according to FactSet data, prompting a trading halt.”

44%

Chinese tech giant Tencent is trading at a massive 44% discount to fair value after Chinese regulators announced crackdowns on sectors from private tuition to gaming, I write: “Wide-moat tech giants Alibaba Group and Tencent Holdings are trading at a 36% and 44% discount to Morningstar’s fair value, respectively. The sell-off in Chinese stocks has also left narrow-moat China Construction Bank trading at a 32%discount to fair value. Billions have been wiped off Chinese markets in the last month as regulators crack down on sectors from technology to private education.”

100%

In a taste of the earnings season to come, Pinnacle announced a 100% increase in its dividends when it reported last week, writes Prashant Mehra: “Diversified investment firm Pinnacle (ASX: PNI) delivered strong numbers with full-year net profit more than doubling to $67 million. Net inflows rose to $16.7 billion, while assets under management jumped 52% to $89.4 billion. It announced a 100% increase in dividends to 17 cents per share. Earnings prospects are bright, with improved market conditions and flow activity resuming post the initial COVID-19 impact, Morningstar equity analyst Shaun Ler said.”

10%

The Reserve Bank of New Zealand has halved the amount of low deposit mortgage lending banks can do to 10%, as it tries to get rising house prices under control, writes Peter Warnes: “Across the ditch, the Reserve Bank of New Zealand has upped the ante on surging house prices. It restricted access to mortgages by halving the amount of low-deposit lending that banks can make to 10% from 1 October, with additional macro-prudential measures also being considered. It is another example of how New Zealand’s monetary, fiscal and taxation policies are ahead of Australia.”

Charts from last week - Tencent's days of pain

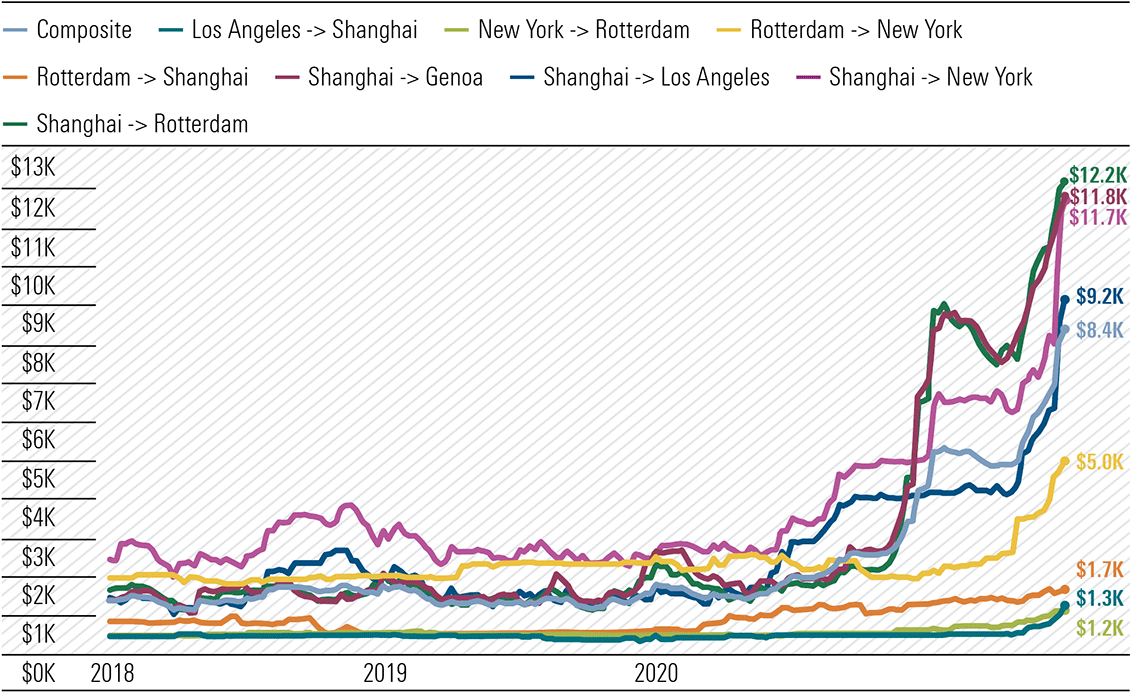

The cost of shipping goods from China has skyrocketed (here)

Source: Arbor Research

Most popular articles

Top videos