Pros and cons of active ETFs

Accessibility, price transparency and no ongoing platform fees are some of the advantages over conventional managed funds.

Actively managed exchange-traded funds have burst into the marketplace, leaving investors to ponder the merits of using an active equity strategy in an ETF wrapper.

Active ETFs are not a contradiction, but an innovation. ETFs are just a vessel, a wrapper in which asset managers package and distribute investment strategies to investors--active, passive, and everything in between. The ETF wrapper can deliver material benefits for investors partnering with active managers.

The differences between actively-managed open-end listed funds—or active ETFs—and traditional unlisted funds can look trivial at first blush, but they are meaningful. As with everything, there are trade-offs.

Advantages

Accessibility. For a retail investor without a financial adviser or access to a costly investment platform, buying units in an unlisted managed fund is difficult. Download a paper application form, print it, complete and sign it and send it via snail mail. Unlisted funds also often have minimum initial investment amounts of $10,000 or more. Because active ETFs are listed on an exchange, investors can buy and sell them as they would a normal share. Units are available to any investor who can cover an ETF’s share price, has a brokerage account (e.g. CommSec, nabtrade) and can meet the broker's minimum order size—typically $500 plus brokerage. No additional paperwork required.

Price transparency. When investors buy units in an unlisted managed fund, the unit price is typically calculated at the end of each business day. As such, investors generally don't know the price until after the transaction. But with active ETFs, the value of the underlying funds is regularly disclosed to the ASX and appears on the issuer's website in the form of the NAV—net asset value per unit—and for some, the iNAV—an indicative intraday net asset value per unit. With live pricing, investors can choose at which price to enter or exit the fund.

Liquidity. Active ETFs are open-ended and issue/redeem units daily via the exchange. This is done either through an appointed market maker or by acting as the market maker on behalf of the fund. As such, investors can trade units throughout the day. But make sure you watch the spread, particularly on less liquid underlying holdings (more on that later).

No ongoing fees. Off-market managed funds are typically accessed via an investment platform such as BT Panorama, HUB24 or Netwealth. While platforms may negotiate lower fees or lower minimum initial amounts for their users, platform fees apply, meaning that investors pay an ongoing fee for holding the fund. Active ETFs bought via the exchange carry no ongoing platform fees.

Tax. The mechanism by which investors withdraw from the ETF can be a tax advantage over managed funds. As ETF provider VanEck explains in an article titled The tax advantages of ETFs, in unlisted funds, units held by withdrawing investors are cancelled and a portion of shares in the fund is sold to pay the investor out. The sale of the shares creates a capital gains tax liability inside the fund.

"The problem is that this CGT liability doesn't fall on the investor who is withdrawing. It falls on the investors who are still in the fund," VanEck says.

"If a lot of investors withdraw from the fund in the same year, this mechanism creates a CGT burden which can become significant for the remaining investors.

"In an ETF this doesn't happen ... An investor who wants to withdraw from an ETF simply sells their units on the ASX. The sale of units does not require a sale of shares in the fund because the ETF units are not cancelled, they are purchased by other investors."

Note: While most passive vehicles have remarkably low portfolio turnover, this is not the case for some actively managed products and strategic beta funds. Passive ETFs employ investment strategies that can contribute to low portfolio turnover. Keeping a lid on portfolio turnover helps minimise trading costs within the vehicle, delays crystallising capital gains, and increases the use of the capital gains tax discount. Not all turnover is bad. Skilled active managers can generate additional performance for investors by making shrewd portfolio shifts that outweigh the costs associated with portfolio turnover.

Drawbacks

Trading costs. Trading active ETF units incur brokerage costs of around $10-$20, depending on the broker. This is a cost borne by investors in listed funds. Bid-ask spreads (the amount by which the ask price exceeds the bid price for an asset in the market) can also vary. For active ETFs that hold global stocks, given the underlying assets trade outside of the ASX’s open hours, there is also potential for spreads to widen during periods of volatility. Morningstar analysts recommend investors use limit orders and avoid trading near the open or close of the market. Always check the bid/ask spread before trading.

MORE ON THIS TOPIC: 10 tips for effective ETF investing

Capacity. The downside to ETFs’ come-one-come-all remit is that they cannot close their doors to new investment, unlike open-end funds. Active open-end fund managers may shut out new investors to manage capacity and protect existing shareholders, especially in corners of the market where capacity can become a concern, like the small-cap space. Indeed, 30 per cent of the actively managed medallists in the US small-cap blend, growth, and value Morningstar Categories were closed to new investors at the end of April 2021. Hot actively managed stock ETFs may encounter liquidity problems or be forced to invest in the managers’ next-best ideas with new money.

Narrower opportunity set. Active-ETF investors also have a narrower asset class opportunity set to draw on than unlisted fund investors. Morningstar data shows there are over 60 active ETFs trading across both exchanges (ASX, Chi-X) from 25 investment managers. While they cover a range of asset classes, many are missing. Others only have one strategy available. This should even out once more strategies become available via the exchange.

Active ETFs by Morningstar Category

.png)

Source: Morningstar

The ASX also has rules for the types of underlying instruments a fund can invest in to be admitted. For example, IPO securities are accepted provided they are limited to less than 5 per cent of the portfolio. Commodities or currencies are accepted if the ASX is satisfied there is sufficient pricing. Funds cannot, however, invest in LICs, infrastructure funds or private equity funds. Nor can they hold shares in unlisted companies or collectibles like artworks or wine. While most active equity funds allocate the bulk of their portfolios to public companies, these considerations limit managers’ opportunity sets. Chi-X's admission rules differ, allowing a greater range of holdings (particularly for the fixed income market), and flexibility around disclosure.

An aside on management fees

In the US, the most pronounced advantage actively managed stock ETFs have over their open-end fund peers is their lower cost. Open-end funds’ fees incorporate marketing, distribution, and shareholder recordkeeping expenses. ETFs don’t factor in these costs.

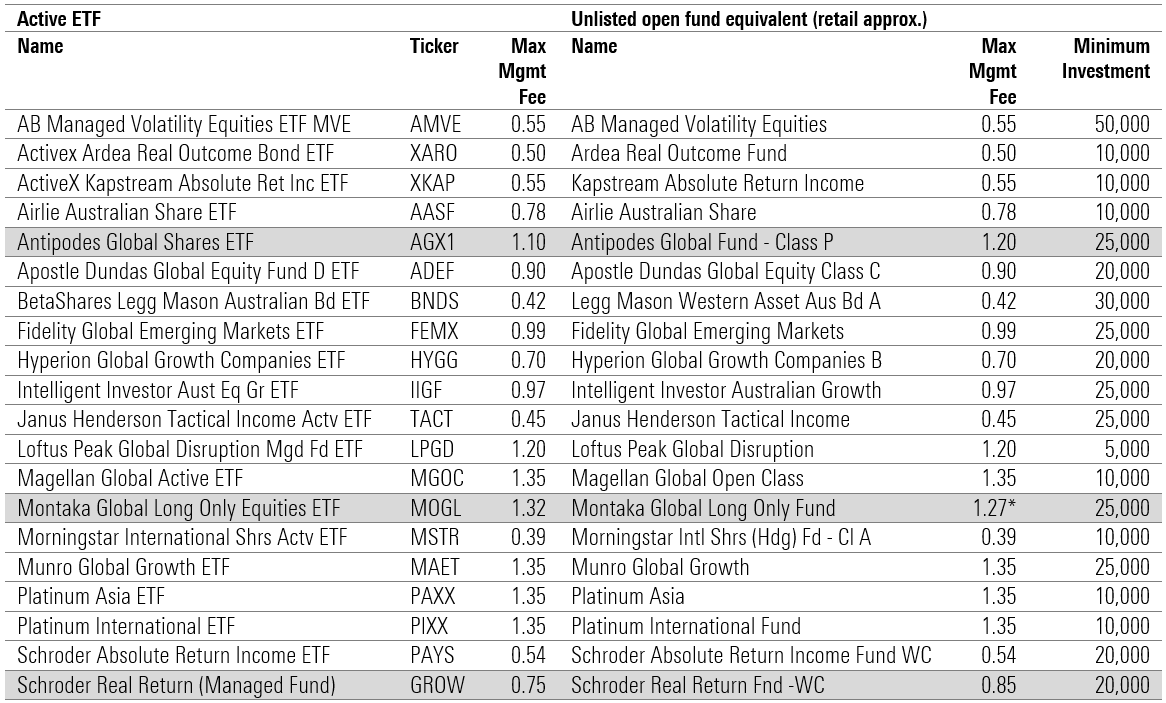

In Australia, the fee difference between actively managed unlisted funds, and their approximate unlisted equivalent is practically non-existent. Most funds charge the same for both entry points. There are a few exceptions where the listed version is cheaper—for example, Antipodes Global Shares ETF 1.10 per cent vs Antipodes Global Fund 1.20 per cent.

Fees on a selection of Active ETFs v Unlisted equivalent

Source: Morningstar. *Management Fee sourced via fund PDS

For the unlisted equivalent, the fund share class with the lowest minimum investment amount has been selected for comparison. Funds with minimum investment amounts over $100,000 have been excluded.

Verdict

Active ETFs have some benefits and drawbacks. While the ETF wrapper can help investors get the most out of active managers, it is just a wrapper, not a panacea for all that has ailed active management.

Given that ETFs trade on an exchange like stocks, any investor with a brokerage account can invest in an ETF. Many unlisted funds aren't easily available to most unadvised retail investors and have substantially higher minimum initial investment requirements. Furthermore, most active ETFs that seek to replicate the strategies plied by their predecessor unlisted funds charge fees that are on par.

In this regard, ETFs are a democratising force. They offer broader, easier access to a larger number of smaller investors at a price that often matches what they charge their biggest clients.

Ben Johnson, CFA contributed to this article. He is the director of global ETF research for Morningstar and editor of Morningstar ETFInvestor, a monthly newsletter.