Magellan waxes as Platinum wanes

Hamish Douglass has got the edge over his fund rival by unearthing steadier returns in different sectors.

Mentioned: Magellan Global Open Class (15699), Platinum International Fund (4505), Magellan Financial Group Ltd (MFG), Platinum Asset Management Ltd (PTM)

For the last decade, only two names in global equity have been on the lips of retail investors: Magellan Global and Platinum International.

The funds rose to prominence under the stewardship of two high-profile and brilliant stock pickers, Magellan’s Hamish Douglass and Platinum’s Kerr Neilson, who successfully guided “mums and dads” through the complexities of global investing.

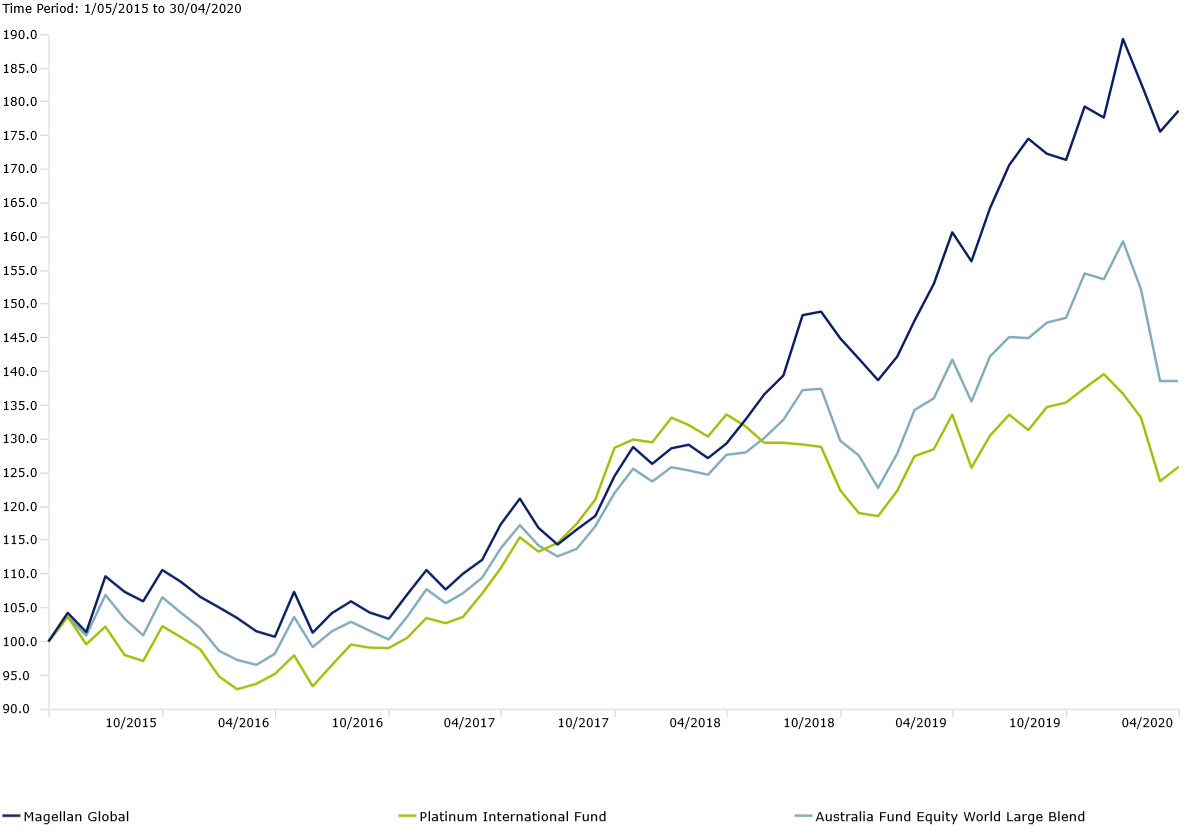

But if recent performance is anything to go by, investors that hitched a ride with Magellan are far better off.

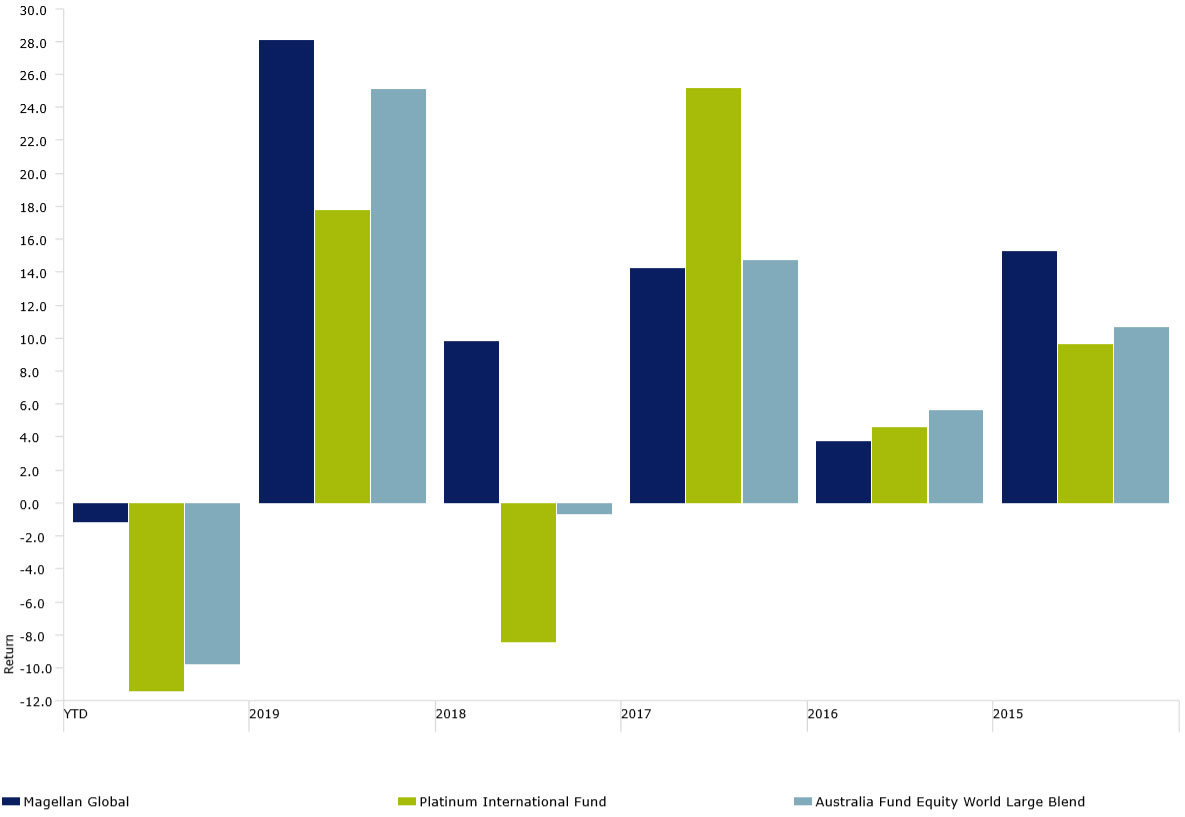

The Platinum International Fund, which was recently downgraded to Bronze by Morningstar fund analysts, delivered bottom quartile returns in the Equity World Large Blend category in 2019, underperforming the category by 7.42 per cent and the MSCI World Ex Australia index by 10.22 per cent. 2018 wasn't much better, underperforming the index by 9.96 per cent.

Neilson relinquished his co-portfolio manager role in 2018 but remains heavily involved as an analyst and remains a significant co-investor in the strategy.

While the fund delivered stellar performance in 2017, returning 25.16 per cent to Magellan Global's 14.23 per cent, the strategies have diverged sharply—one taking a bet on developing markets in Asia and the other on US tech giants.

The Gold-rated Magellan Global outperformed the MSCI World Ex Australia index over the past two years, topping the category in 2018 with returns 9.30 per cent above the index.

Investment growth, 5 years | Magellan Global, Platinum International, Category

Source: Morningstar Direct

Senior Morningstar fund analyst Matthew Wilkinson puts Platinum's recent underperformance down to two key issues: a patchy track record at using its many investment tools; and a weakened investment team.

Platinum's investment approach is about identifying companies with business and growth prospects that are underappreciated by the market.

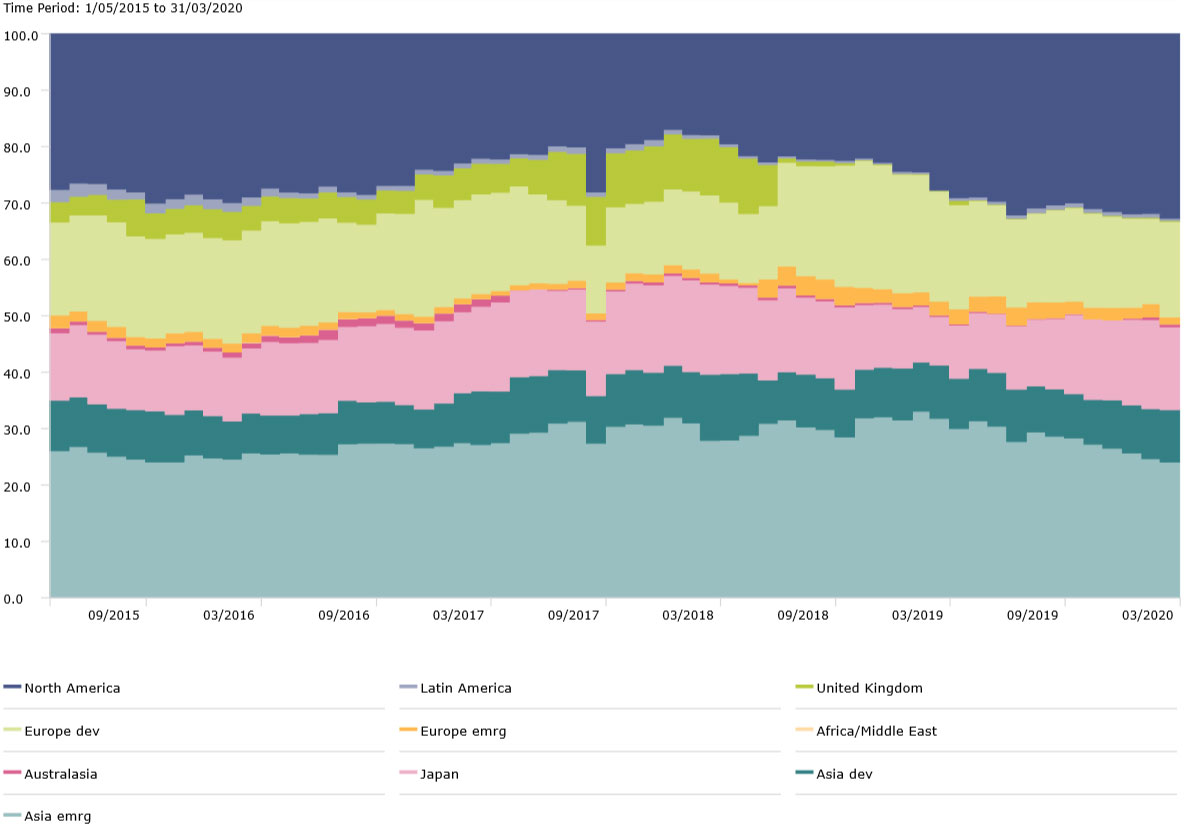

Wilkinson says a near 40 per cent underweighting the US over five years to 31 December 2019 has proved costly. Platinum has instead heavily favoured companies in the Asian region, especially China and India, with a 40 per cent exposure. Both low interest rates and trade tensions were unsupportive of this investment style.

"While Platinum has employed the same process since 1995, its many moving parts have struggled to deliver consistent outcomes," he says.

"The process is valuation-conscious, well-researched, and often thematically tilted, but it’s one where the portfolio managers express their views via short-selling, currency positions, net exposure and meaningful sector and regional tilts.

"Their predilection to avoid the crowded trades while looking to get ahead of the next one precipitates significant benchmark-relative risks.

"Despite impressive downside protection, the process requires many investment settings to be right to consistently beat the benchmark."

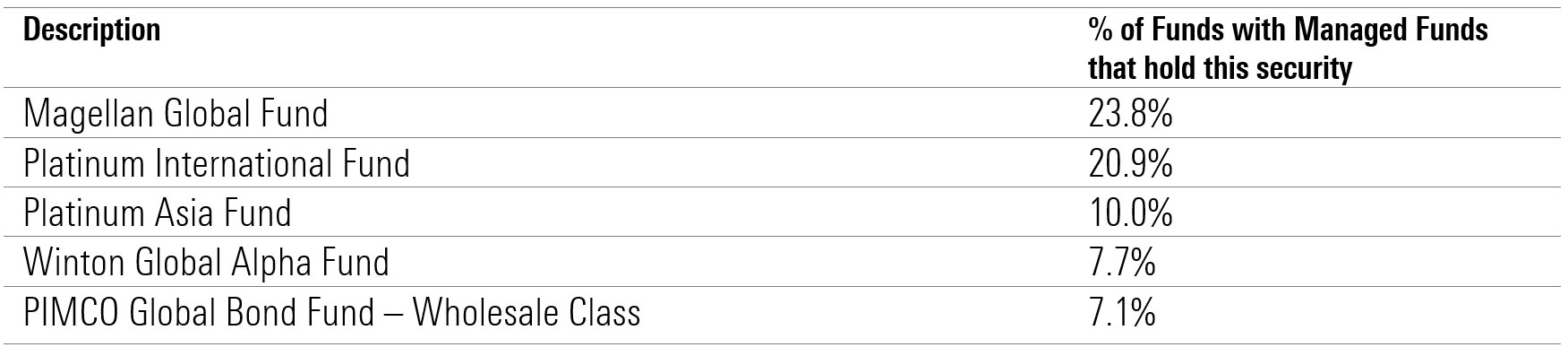

SMSFs | Top 5 Investment Holdings, Managed Funds, March 2019

Source: Class SMSF Benchmark Report

Wilkinson says several of Platinum's cyclical stocks have hurt the portfolio over the past five years, especially in energy and material sectors.

"Long holdings in companies like Peabody Energy, Seven Generations, and Glencore have detracted, as have several short positions including the Nasdaq index, Tesla Motors, and MongoDB," he says.

"In fact, short positions have detracted overall for the five years to the end of 2019."

On the investment team, Wilkinson says while co-portfolio managers Andrew Clifford and Clay Smolinski both display impressive insights and have a wealth of experience, a lack of stability outside the top ranks has marred Platinum.

Portfolio manager Simon Trevett departed in 2017, as well as experienced analyst Curtis Cifuentes, and in 2018, long time Asia analyst Doug Huey departed. Portfolio manager Jacob Mitchell left in late 2014 along with a handful of analysts.

"While we still applaud the analyst research overall, they have slipped from being one of the best global equity teams in our view," Wilkinson says.

Regional exposure | Platinum International

Source: Morningstar Direct

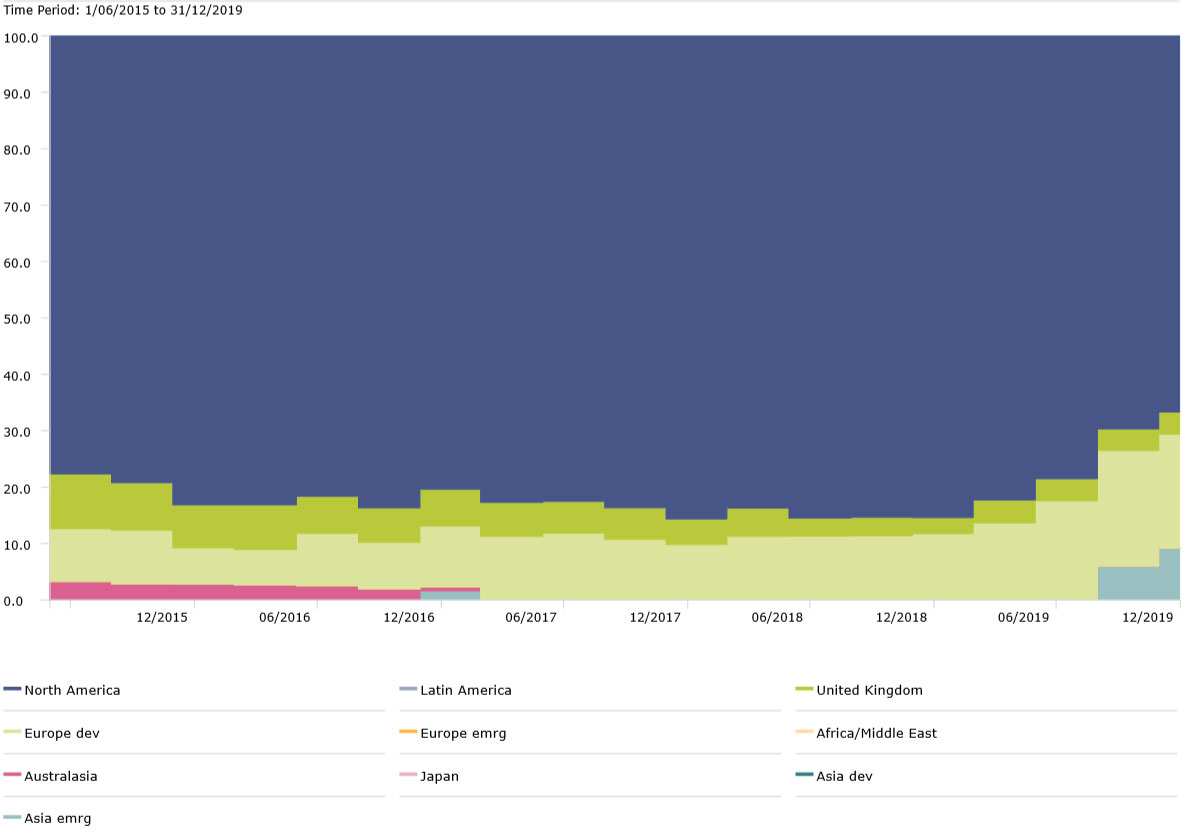

Magellan Global's trajectory tells a very different story. Unlike Platinum, Magellan has had a notable bias to US-domiciled multinationals, with a 66.7 per cent holding in the region today. Douglass has exposed the portfolio to what he views as "technology winners", with positions in large-cap consumer tech platforms such as Facebook and Alphabet, electronic payments like Visa and Mastercard and enterprise software such as Microsoft and SAP.

This strategy has produced stellar performance, particually over the last two years, says Morningstar senior analyst Andrew Miles. Magellan’s fundamental bottom-up approach seeks companies with sustainable competitive advantages that can grow more quickly than the overall economy.

"Magellan Global has an excellent long-term track record," he says. "Measured over all rolling three-year periods from its inception in June 2007 to 30 March 2020, the strategy has achieved peer-average beating returns 89 per cent of the time.

"Superior downside protection in 2008, 2011, late 2018 and early 2020 saw this fund stand well apart from peers, but the strategy has also delivered excess returns over many years with a high degree of consistency."

More recently, the strategy made its first foray into Chinese online behemoths, adding Alibaba and Tencent.

Regional exposure | Magellan Global

Source: Morningstar Direct

Miles says performance was buoyed in the first half of 2018 by Magellan's holdings in major tech firms. He adds defensive consumer franchise holdings such as Yum Brands, McDonalds, and Starbucks helped offset falls from Apple and Facebook in the last quarter of 2018. Miles says Douglass also used cash shrewdly to protect the portfolio.

"This has contributed to an exceptional track record since inception (in 2007) to March 2020, thumping both the index and category peers" he says.

Its track record is not without blemishes. 2016 was a rare period when the strategy lagged, wrong-footed by Brexit and falling bond yields in the first half, and the Trump reflation trade in the second.

So far this year, the strategy defended admirably, dropping 1.2 per cent versus the index’s 9 per cent loss.

Calendar year returns | Magellan Global, Platinum International, Category

Source: Morningstar Direct

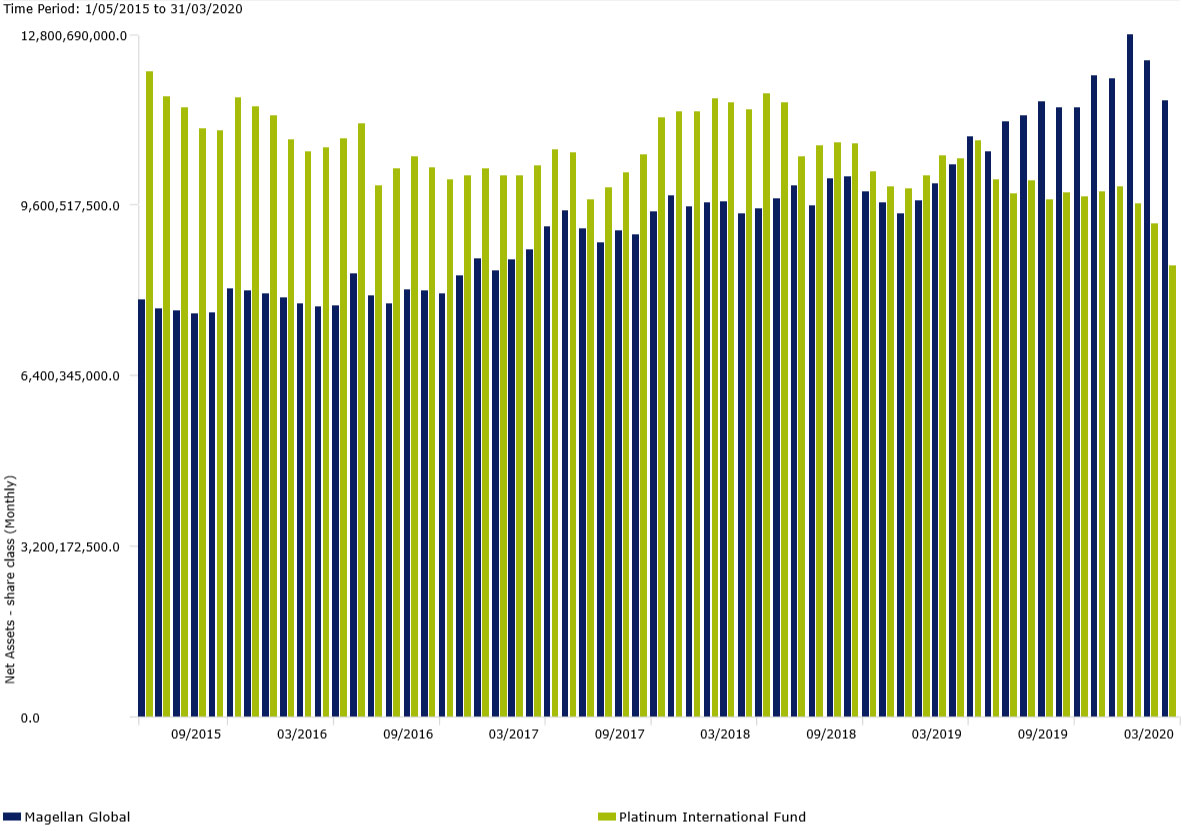

Success has led to rampant growth at the company level. Magellan Financial Group (ASX: MFG) managed $97 billion at the end of 2019, with $72 billion in the Global strategy. $12 billion of this belongs to retail investors, up from $9.6 billion in 2017. This makes Magellan the 5th largest fund group in the Australian market.

Platinum Asset Management today manages about $22 billion. Net assets for retail investors in the Platinum International fund have fallen from $11.4 billion in 2017 to $10 billion in 2019.

Morningstar director of equity research Adam Fleck expects Platinum (ASX: PTM) to see further net outflows due to a combination of its historical underperformance and potential risk-aversion toward emerging market stocks.

He says Platinum and Magellan possess the necessary brand strength, investment strategy, and distribution reach to navigate the current downturn and to continue to attract inflows longer term. But Magellan has a competitive edge over should recover faster.

"Compared with Platinum, we think that Magellan possesses a stronger distribution reach and greater client engagement, which helps with driving growth and building a stickier funds under management base," Fleck says.

"[Platinum's] inflows should resume over the longer term as investors see the merits of its absolute-return focused strategy and downside protection capabilities, which should outperform amid current volatile markets."

Net assets (retail) | Magellan Global, Platinum International

Source: Morningstar Direct