US inflation pressures easing but still sticky

The latest US inflation report leaves Fed likely on track for a rate-hike pause.

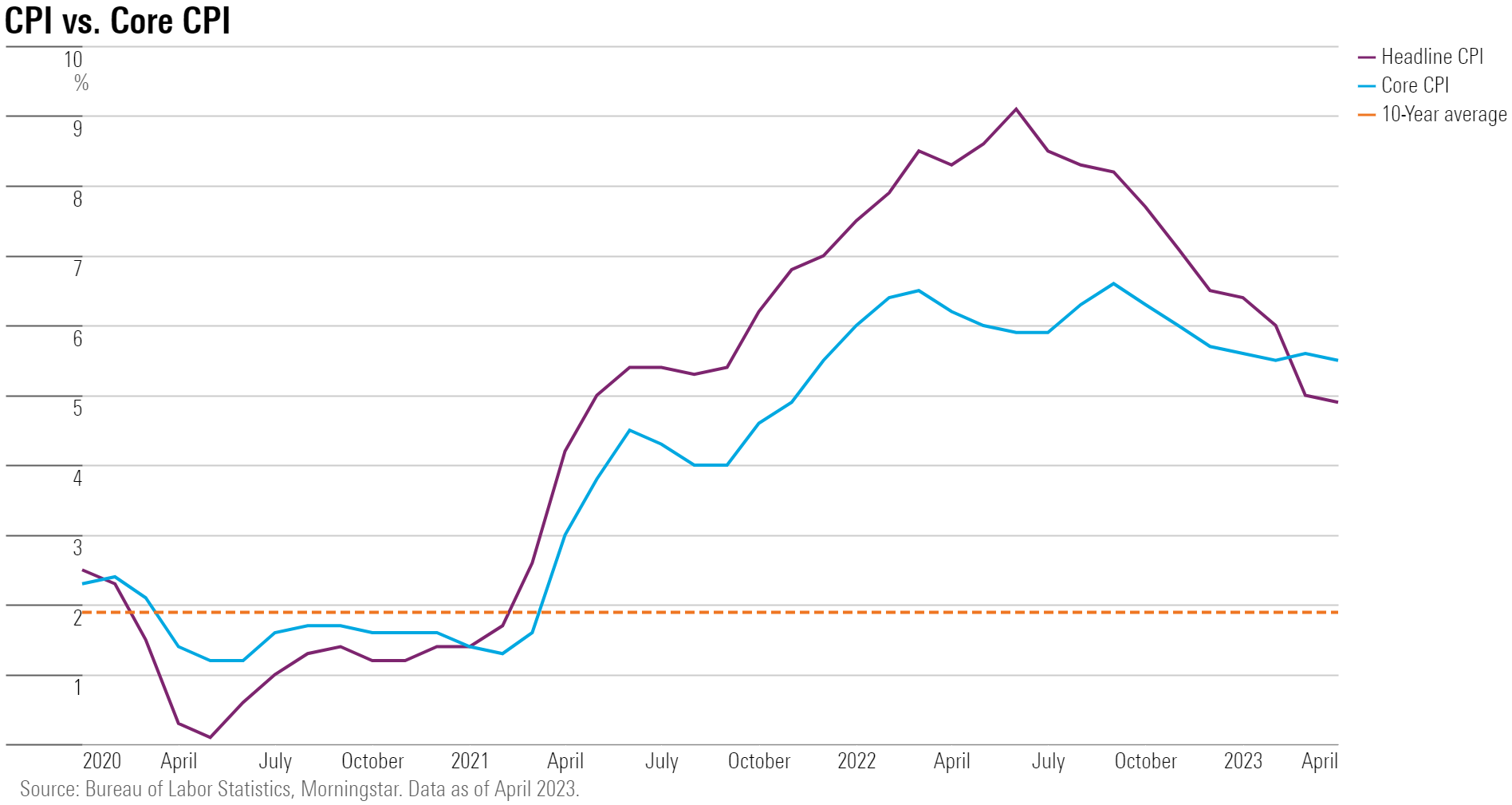

While the April US Consumer Price Index report showed that upward pressure on prices moderated a touch last month, inflation continues to take a meaningful bite out of consumers’ wallets.

The report showed prices rising on shelter costs—which includes rents—along with used cars and trucks and the index used to track gasoline prices.

However, the overall annual inflation rate ticked down to 4.9% in April from 5% in March, standing well below December’s 6.5% annual rate and readings north of 8% in late 2022.

For investors, this likely leaves the Fed on track in June to hit the pause button after interest-rate increases at 10 consecutive policy-setting meetings.

However, the Fed is seen as needing further improvement in inflation before lowering interest rates, barring a sudden negative shock to the economy. It has raised interest rates aggressively over the past year in order to slow the economy and push inflation down toward its 2% target rate as measured by the Personal Consumption Expenditures price index.

“Today’s report was a mixed bag in terms of progress against inflation,” says Morningstar’s chief economist Preston Caldwell. “But without signs of inflation getting worse, we still expect the Fed to pause on rate hikes at its next meeting in June.”

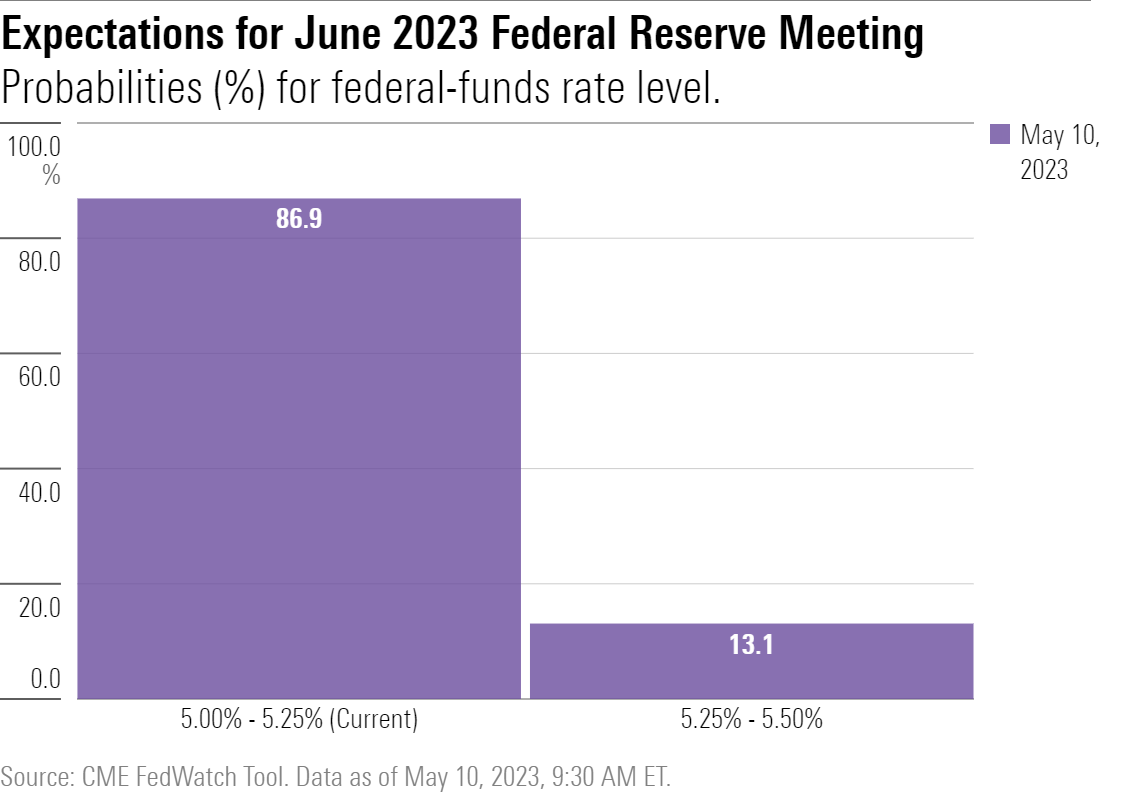

The Fed last week raised its target for the federal-funds rate by 0.25 point to a range of 5.00%-5.25% and removed language from its official statement suggesting that additional rate increases were likely.

While observers widely expect the Fed to hold rates steady in June, bond traders in the futures market have gone a step further, placing bets that reflect expectations for the Fed to start cutting interest rates as soon as September, if not July.

The Bureau of Labor Statistics reported the CPI rose 0.4% in April from the previous month, in line with economists’ forecasts and up from a 0.1% reading in March. Excluding volatile food and energy costs, the CPI rose 0.4% in April, also near economists’ expectations and at the same pace as in March.

Markets prepare for an interest rate pause

The great majority of market participants now expect the federal-funds effective rate target to hold steady at its current range of 5.00%-5.25% at the Fed meeting on June 14, according to the CME FedWatch Tool. Expectations haven’t changed materially from their week-ago levels.

“While progress has been slower than hoped, inflation has already fallen greatly compared with its peak. The Fed’s previous tightening still probably has a long way to play out in terms of slowing down the US economy.” Caldwell says the current situation argues for a period of wait-and-see.

Further out, the majority of market participants now foresee the Fed lowering its target rate back to a range of 4.25%-4.50% by December. Less than 1% of market participants expect the current rate to hold steady through the end of the year.