What did Morningstar subscribers buy and sell during earnings season?

And what do our analysts think of the stocks?

What do our analysts think about Morningstar Investor subscriber's earnings season trades?

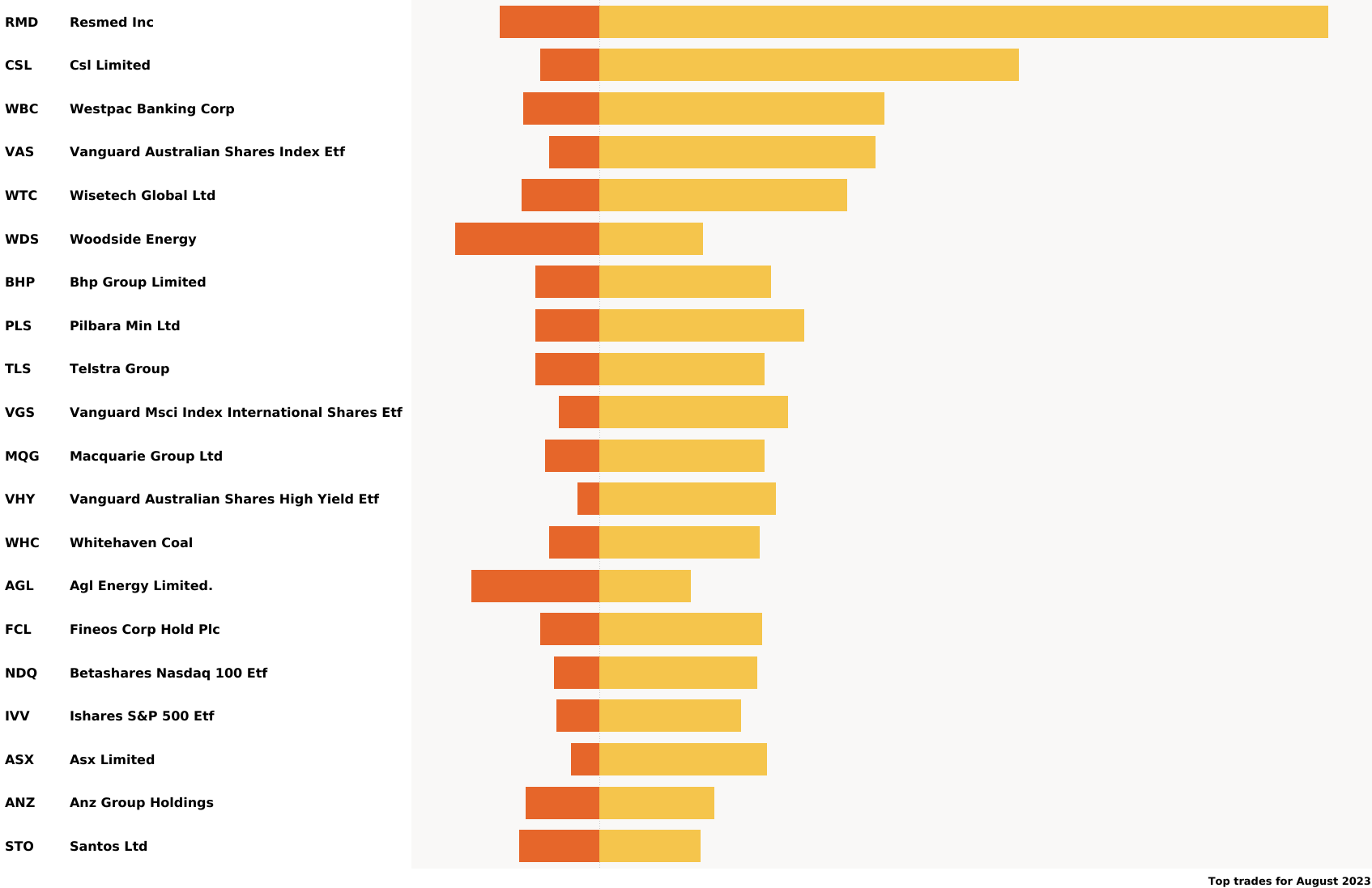

Sharesight is a portfolio tracker that is integrated into Morningstar Investor. Their data shows the top 20 trades by Morningstar users in August 2023. Here’s what our analysts think about the top buy trades, and the largest sell.

Top buy trade: Resmed (ASX: RMD) ★★★★★

Our analyst maintains the fair value estimate for Resmed after earnings results (USD 258 fair value or AUD 39 per CDI at current exchange rates). Revenue forecasts after the announcement are broadly unchanged and long-term assumptions are intact.

The negative valuation impact from slightly lower midterm earnings was largely offset by the time value of money and a lower forecast tax rate of 20% from 21% prior. The firm is still selling through higher-cost invesntory and the full benefits of normalizing freight and component costs after the last few years is yet to flow through. This will mean margin expansion as the unit costs decrease through scale and lowering of costs. Shares remain materially undervalued.

Morningstar Investor subscribers can see the special report “The Start of Unconstrained Sales for ResMed," published on July 25, 2023, which delves deep into the key drivers supporting our forecast elevated sales growth.

ResMed is one of the two leading players in the global obstructive sleep apnea, or OSA, market. With cloud-connected devices, physicians can monitor patient compliance and encourage continued use. The global OSA homecare device market, is a two-player duopoly with over 80% estimated market share split between ResMed and Philips, with ResMed the market leader in the majority of the 140 countries it competes in.

Higher adherence supports both reimbursement rates from payers and the resupply of masks and accessories. ResMed also plays a key role in producing clinical data that demonstrates treatment can minimise related risks such as hypertension, stroke, heart attack and Alzheimer’s disease. Through its own testing devices and education, ResMed seeks more widespread diagnosis and treatment of OSA.

Top buy trade: CSL Limited (ASX:CSL) ★★★★

After earnings season, We keep our long-term estimates broadly unchanged, but we increase our fair value estimate by 5% to AUD 330 largely due to the time value of money and the stronger U.S. dollar relative to the Australian dollar.

CSL is currently considered undervalued. CSL is one of three tier one plasma therapy companies that benefit from an oligopoly in a highly consolidated market. All the players are vertically integrated as plasma sourcing is a key constraint in production. The plasma sourcing market is currently in short supply, however, CSL is well positioned having invested significantly in plasma collection centres, owning roughly 30% of collection centres globally.

We award CSL a narrow moat rating based on the cost advantage afforded by its large-scale plasma collection and fractionation (this is where the various components of blood plasma are separated). CSL also possesses intangible assets based on the intellectual capital in its existing products and the proven success of its R&D efforts over time. The industry has high barriers to entry as plasma fractionation has long lead times, taking approximately seven years to be built and approved. Fractionation is also a complex process that requires significant expertise and scale to be performed cost-effectively.

Top sell trade: Woodside Energy (ASX: WDS) ★★★★

Our fair value estimate for no-moat Woodside is unchanged at AUD 45. The global top 10 independent hydrocarbon producer reported a 4% increase in underlying first-half 2023 net profit after tax to USD 1.9 billion or AUD 1.48 per share, about 6% ahead of our USD 1.8 billion expectations. However, the makeup of the result was skewed by some one-offs and we keep our 2023 EPS forecast of AUD 2.65.

Woodside shares are more than double AUD 17.50 October 2020 lows, but at around AUD 38 remain materially undervalued in 4-star territory. Cost-effective delivery of Scarborough/Pluto T2 in particular should be a key catalyst for price appreciation.

While we see limited implications for long-term assumptions, the result did disappoint in some elements. Higher-than-expected operating costs were offset by a lower-than-anticipated tax rate. Costs reflected plant turnarounds, inflationary pressures, and a full period’s contribution from BHP Petroleum assets changing the mix.

As Australia's premier oil player, Woodside Petroleum's operations encompass liquid natural gas, natural gas, condensate and crude oil. However, LNG interests in the North West Shelf Joint Venture, or NWS/JV, and Pluto offshore Western Australia are the mainstay, and the low-cost advantage of these assets form the foundation for Woodside. Future LNG development, particularly relating to the Pluto project, encompasses a large percentage of this company's intrinsic value.