29 quality stocks at great prices

Great companies carve out a solid competitive advantage and as coronavirus rattles markets many such names are trading at hefty discounts, says Morningstar.

Mentioned: Auckland International Airport Ltd (AIA), Ansell Ltd (ANN), Brambles Ltd (BXB), Macquarie Group Ltd (MQG)

Editor's note: Read the latest on how the coronavirus is rattling the markets and how investors can navigate the volatility.

Market shocks can be cause for anxiety but if you have the capital, such shocks can be an opportunity to pick up the stocks of great companies at discounts.

Investors define “great” in different ways. From our perspective, great companies are those that have carved out solid (and in some cases growing) competitive advantages that will allow them to thrive for years to come--in Morningstar parlance, they’ve built economic moats. Such companies are typically led by adept managers who have a record of allocating capital in ways that add value.

To find such exceptional firms, we looked for the following qualities.

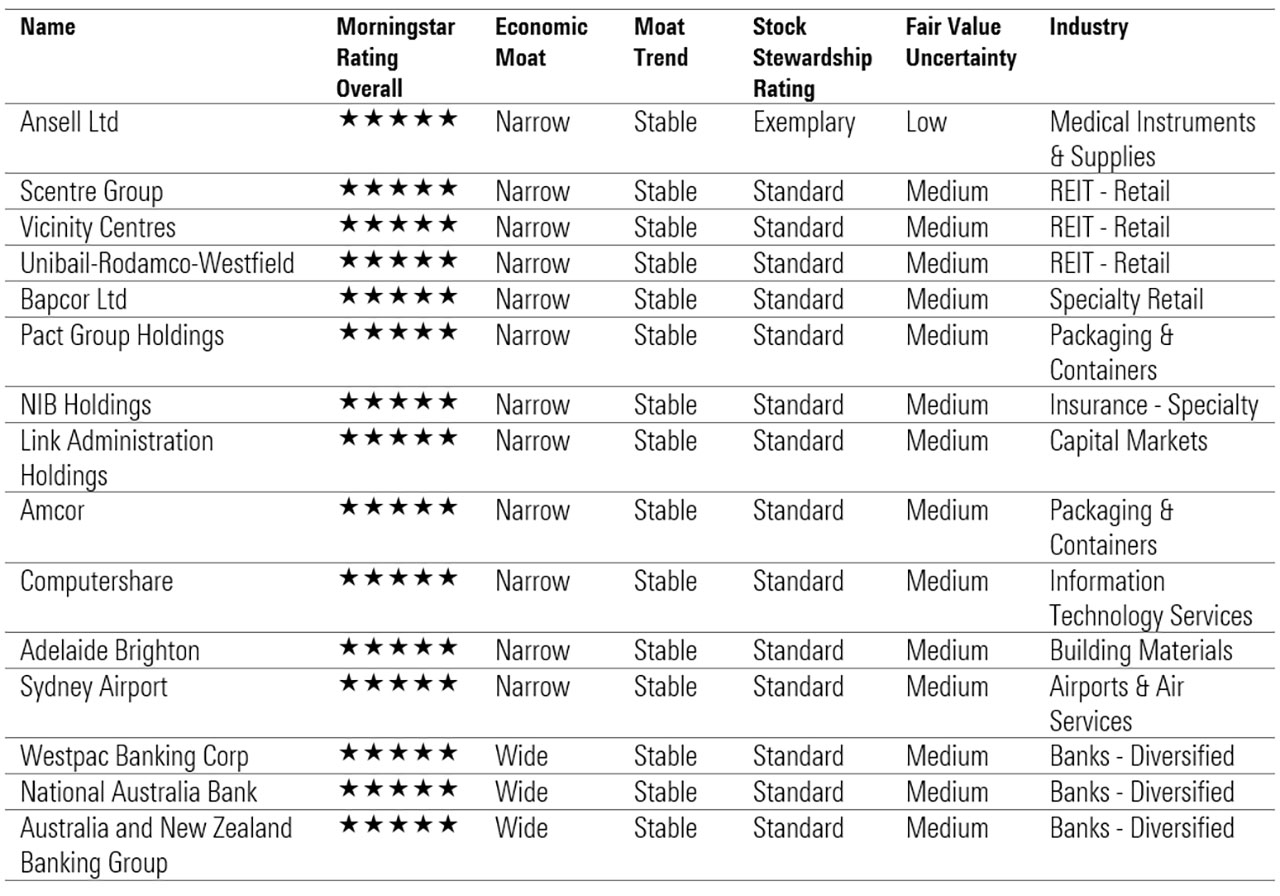

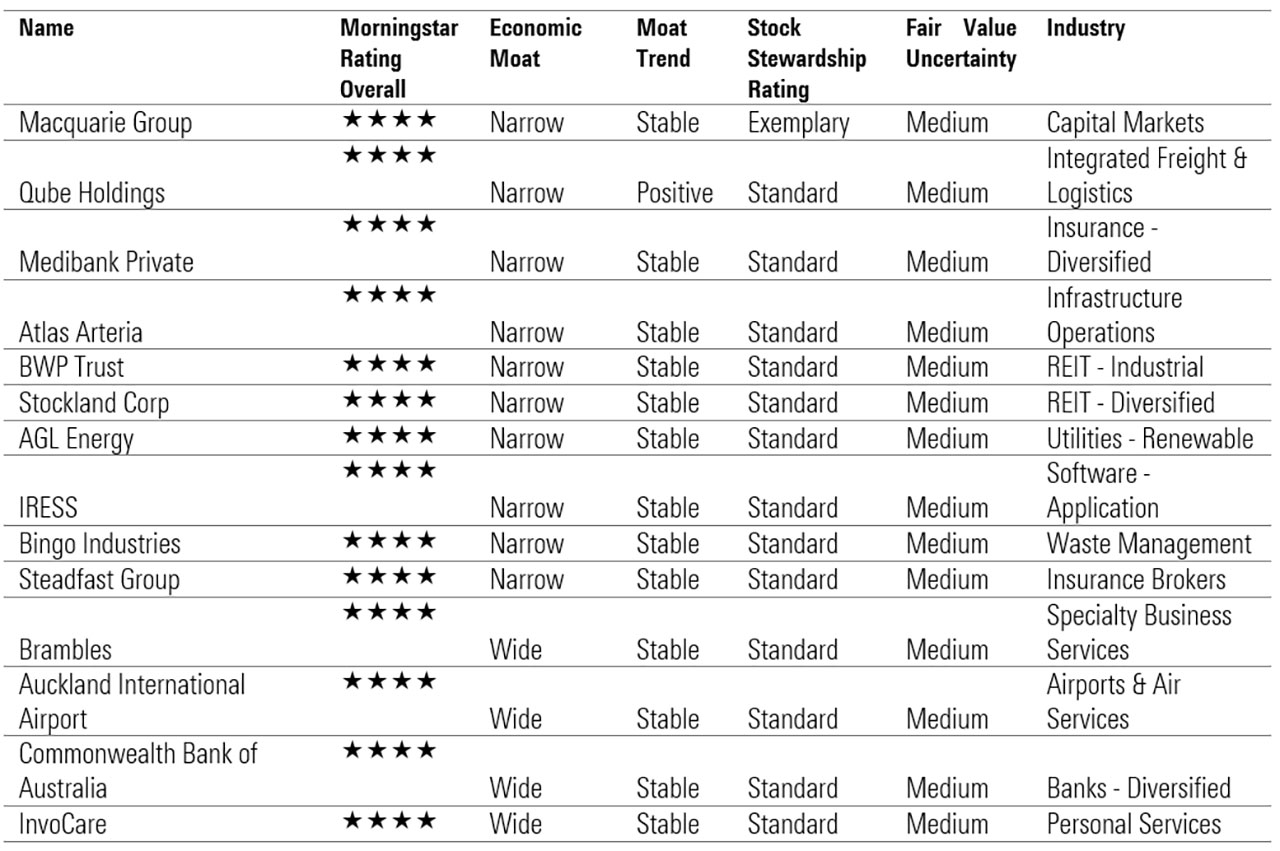

- Economic moat: First, they need to boast wide or narrow Morningstar Economic Moat Ratings--and their Morningstar Moat Trend Ratings need to be stable or positive. In other words, these companies have competitive positions that are steady or even improving.

- Exemplary stewardship: Second, they must earn our top Morningstar Stewardship Rating—exemplary or standard. In other words, these companies are led by exceptional corporate managers who have a proven record of making investments and acquisitions supporting the competitive advantages and core businesses of their companies--and they won't pay an arm and a leg to do so. They'll divest underperforming or noncore businesses. They'll find the right balance of investing in the business and returning cash to shareholders via dividends and share repurchases. And they'll assemble a portfolio of attractive operating assets and skilled human capital, and then execute well.

- Fair value certainty: Third, we need to have a high degree of certainty in our fair value estimates for the stocks of these companies, limiting our search to stocks with fair value uncertainties of low or medium. This rating represents the predictability of a company's future cash flows. As such, we have a pretty high degree of confidence in our fair value estimates of companies with low and medium uncertainty ratings. (Long version: The uncertainty rating captures a range of likely potential intrinsic values for a company based on the characteristics of the business underlying the stock, including such things as operating and financial leverage, sales sensitivity to the economy, product concentration, and other factors. If the range of potential intrinsic values is narrow, the company earns a low uncertainty rating. If the range is great, the company earns a high uncertainty rating.)

- Discounted: And lastly, the stocks of these companies must be trading at a decent discount to our fair value estimates--selling at Morningstar Ratings of 4 or 5 stars at the of writing.

We used the ![]() Morningstar Stock Screener to look for these qualities. More than two dozen stocks made the cut.

Morningstar Stock Screener to look for these qualities. More than two dozen stocks made the cut.

Related article: Morningstar's eleven: How to spot a wide-moat stock

Two stocks stood out as holding exemplary stewardship ratings - medical instruments & supplies company Ansell Ltd (ASX: ANN), and capital markets firm Macquarie Group (ASX: MQG).

For wide-moat stocks, the big four banks carry our highest rating for competitive advantage, alongside funeral home operator InvoCare Ltd (ASX: IVC), Auckland International Airport (NZX: AIA) and supply chain logistics company Brambles (ASX: BXB).

Don't think of this as a list of "buys," though. Instead, think of it as a collection of names to investigate further.

"A 5-star rating does not suggest that the stocks won't drop further," he says. "Our aim is not to pick the bottom, but to highlight to investors that they can pick names up at a discount," Johannes Faul, Morningstar director of equity research, explains.

Note: This is a snapshot of how these stocks stand at the time of writing: Tuesday 17 March at 3pm. Given the current market volatility, the valuations could jump around.

5-star Australian stocks

- Wide or narrow moat

- Stable or positive moat trend

- Exemplary or standard stewardship rating

- Low or medium fair value uncertainty

Source: Morningstar

4-star Australian stocks

- Wide or narrow moat

- Stable or positive moat trend

- Exemplary or standard stewardship rating

- Low or medium fair value uncertainty

Source: Morningstar