Afterpay price leaves little room for error: Morningstar

The market has great expectations for the buy now, pay later success story but Morningstar's Shaun Ler believes they're unlikely to be met.

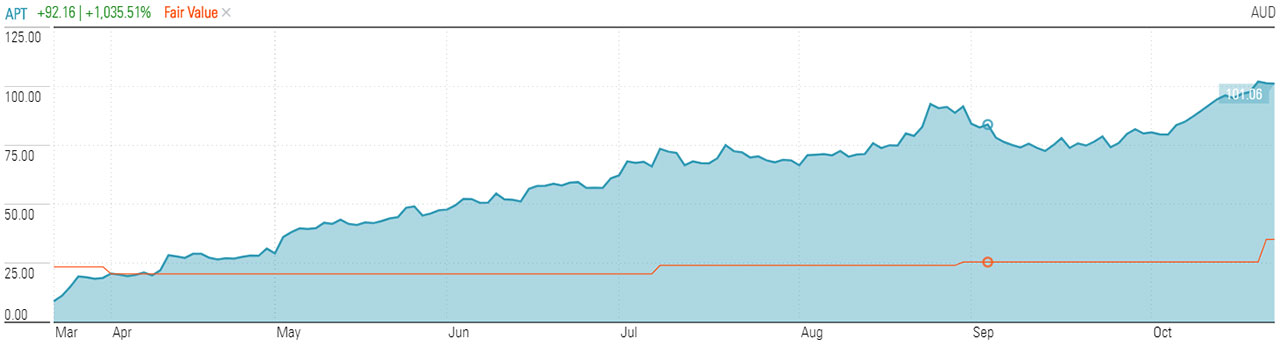

Morningstar analysts have lifted their fair value for leading buy now, pay later provider Afterpay but warn the stock is significantly overvalued as it pushes past $100.

Equity analyst Shaun Ler upgraded his price target for Afterpay (ASX: APT) by 38 per cent to $35.10 on Wednesday after re-examining the outlook for Australia's fast growing BNPL sector.

While Ler says Afterpay's earnings prospects are strong, forecasting earnings per share growth to exceed 20 per cent per year from fiscal 2022 to 2030, he says its current share price expects too much from the company while ignoring the risks.

APT trades at a 195 per cent premium to Morningstar's valuation following its record high share price in the days following its tie-up with Westpac (ASX: WBC). Shares have grown a staggering 1000 per cent since 23 March lows of $8.90.

"Afterpay is well placed to continue growing its share of the BNPL market, leveraging off the growth of e-commerce and cashless payments, consumer demand for interest-free financing and merchant needs for effective marketing," Ler says.

"But its share price trades at a significant premium to our valuation, which in our view, ignores its need for capital, competitive pressures, and increasing regulatory spotlight as it continues to grow its user base."

Price chart v fair value| Afterpay (ASX: APT) since March lows

Source: Morningstar

Industry market research firm IBISWorld anticipates the BNPL industry to grow 9.1 per cent in 2020-21, taking it to $741.5 million of online shopping revenue. Names including Afterpay, Zip Co (ASX: Z1P) and Swedish company Klarna are expected to take a slice of the growth.

The industry’s growth comes as Australia's love affair with credit cards sours. Reserve Bank of Australia data shows credit card debt has hit its lowest level since 2004, with Australians wiping $6.3 billion of debt accruing interest from their credit cards this year. The number of cards in circulation is also down to its lowest levels since 2008, which RateCity research director Sally Tindall puts down to the growth of the BNPL sector.

“While we’re unlikely to see credit cards disappear altogether, they’re no longer the kingpin of credit," Tindall says.

Afterpay reported a net loss of $19.8 million for the 12 months ended 30 June, down from $42.9 million a year ago.

The company said it had more than doubled the number of active customers to 9.9 million in its key markets across Australia, New Zealand, the US and UK. An average of 17,300 new customers were added to its books each day in of FY20, with growth accelerating as the coronavirus pandemic took hold and lockdowns forced people to turn to online shopping.

Mounting risks

Ler believes Afterpay has strong growth prospects in the near term. He forecasts rapid growth in underlying sales and net transaction profit of close to 50 per cent per year in the next five years. But he questions whether Afterpay has a competitive edge over its peers and has retained Morningstar's no-moat rating as he picks up coverage of the stock. A moat rating implies has a company as a ten-year competitive advantage.

Firstly, he says the company is vulnerable to competition due to "low barriers to entry" and "the commoditised nature of payment financing". Ultimately, he doesn't see Afterpay achieving the same penetration rate and transaction frequency overseas as it has domestically amid a global recession and increased competition.

"Numerous institutions and start-ups are trailing Afterpay overseas, replicating its features, catering to a wider audience via a Pay Anywhere model, or undercutting merchant fees," Ler says.

"The sugar hit from fiscal stimuluses and aggressive marketing, which have fuelled consumer spending, can only last so long before running out of steam."

Second, Ler says the "threat of material value destruction" from a potential regulatory cracksown is real. He sees a lack of credit checks as a key concern, as well as the risk of Afterpay being considered a credit provider, in addition to the possible banning of the "no-surcharge" rule. This controversial rule prevents BNPL merchants from passing the costs to customers.

Afterpay told a Senate inquiry into fintech that it doesn't need credit checks because it caps late fees and stops consumers from spending once they fall behind on a payment.

Third, Afterpay risks being unable to secure enough financing for growth—or having to do so under unfavourable terms, Ler says.

"Hefty expectations are being priced into the stock with no room for error."

Afterpay's early success in the US and UK suggests the product is scalable and is resonating, Ler says. He believes further growth will come from its entry to Europe (through the $82 million acquisition of Spain-based Pagantis) and Canada, US in-store rollout, and expansion into new categories via its partnership with eBay Australia.

Ler also applauded the company's initiatives to increase the "stickiness" of its product via its loyalty program and the rollout of Afterpay savings accounts with Westpac, announced earlier this week.

"This collaboration benefits Afterpay by helping it lock-in its users, improve its credit decisioning process and potentially earn a share of the retail deposit margin."