Will the proposed corporate tax cut make a difference?

Adam Fleck, our Director of Equity Research in Australia, looks at the potential impact of the proposed coporate tax cut on our fair value estimate of Australian equities

It’s easy to look at the Australian government’s proposed corporate tax cut to 25% from the current 30% and conclude that most domestic firms will benefit. But the potentially lower corporate tax rates have little impact to our fair value estimates across the board. The new law features an extremely long phase-in period, won’t impact any non-Australian earnings, and will penalise companies that have a high amount of gearing in their capital structures due to a more-muted positive impact from the interest tax shield on their cost of capital. Perhaps most importantly, many companies will likely fail to enjoy long-term benefits to their bottom lines, as lower tax rates will be competed away in the form of lower prices, higher employee wages, or some combination of the two.

Even in a best-case scenario, we estimate long-run cash flows would increase about 7% for companies that are entirely Australian focused, with no balance sheet gearing and an ability to hold on to tax-related gains into perpetuity, as these firms would keep 75% of pre-tax income versus 70% previously.

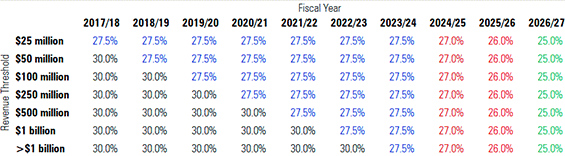

But the lengthy phase-in period of the new tax law dilutes most short-term benefit to our valuation, given any long-run earnings improvement would need to be discounted back to today. Under the proposed law, all companies will see their tax rate eventually fall to 25% by fiscal 2026/27, but the phasing is different depending on the size of the firm. For companies with revenue greater than AUD 1 billion, this process won’t begin until fiscal 2023/24, when tax rates will fall to 27.5%.

Even over the longer term, we expect two offsetting potential negative impacts on valuation: a lower positive impact from the interest tax shield on a company’s cost of capital—particularly impactful for highly geared firms; and the lower tax rates being passed on to customers through lower prices or employees through higher wages, essentially competing away the bottom-line benefit for corporations. While firms would still keep 75% of pre-tax income, the initial earnings stream for many firms will likely be lower as a result, and would need to be discounted at a higher rate for highly-geared companies given the higher after-tax cost of debt.

Nonetheless, we can isolate these variables to find a subset of companies that stand to benefit most from the tax cuts. In keeping with Morningstar's equity research methodology, we believe that that narrow- and wide-moat companies and their shareholders, particularly those in unregulated industries, would retain the benefits of tax reform for an extended period of time. We’ve used this screen, along with firms paying a tax rate north of 28%--implying they’re earning most of their income from Australia—and with a low amount of debt in their capital structure (greater than 80% equity to total capital) to outline which companies we cover that could have the most to gain under the new tax regime.

With the cohort above, we think API, Bapcor, Domino’s Pizza, and Ramsay Healthcare look particularly attractive, as they trade at sizable discounts to our fair value estimates. Similarly, smaller companies stand to benefit sooner, given the more-rapid proposed drop in tax rates for firms with revenue less than AUD 1 billion. We’d highlight InvoCare, MYOB, and Platinum Asset Management—each also trading below our fair value estimates—as smaller-cap names to keep on your watch list.

However, it’s worth reiterating that the potential boost to valuations is minimal at this point, even for these firms. And there’s always the risk that a change in government could roll back these changes before they even get going, or that tax cuts are spent more on shareholder activities such stock buybacks rather than benefitting workers or consumers, making the cuts politically unpalatable. For us, it’s safe to say that the underlying cash flow growth, and return on invested capital in the business, play a much larger part in determining valuation than these proposed changes to long-term tax rates.