Why the US Fed could cut rates later this year

Morningstar's Preston Caldwell maps out four potential near-term scenarios for the US economy.

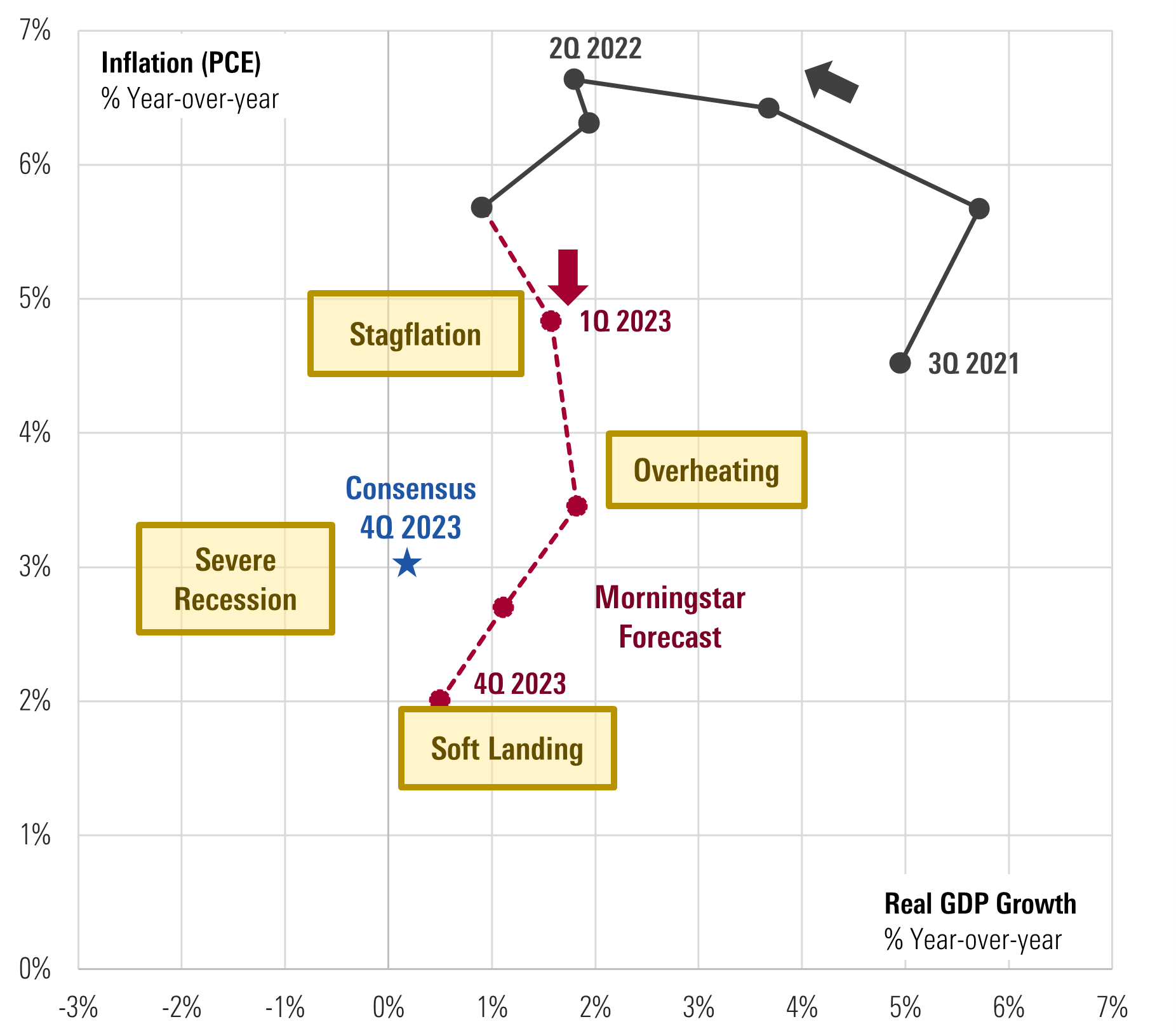

Our outlook for the US economy remains generally more optimistic than consensus, as we forecast stronger gross domestic product growth and lower inflation. We place the probability of recession risk at just 25% for the next two years.

Still, we think the binary question of whether a recession will or won’t occur misses the point. Any recession is likely to be short-lived, and we expect US GDP growth to rebound strongly in 2024.

Fed to shift back to easing after victory over inflation looks clear

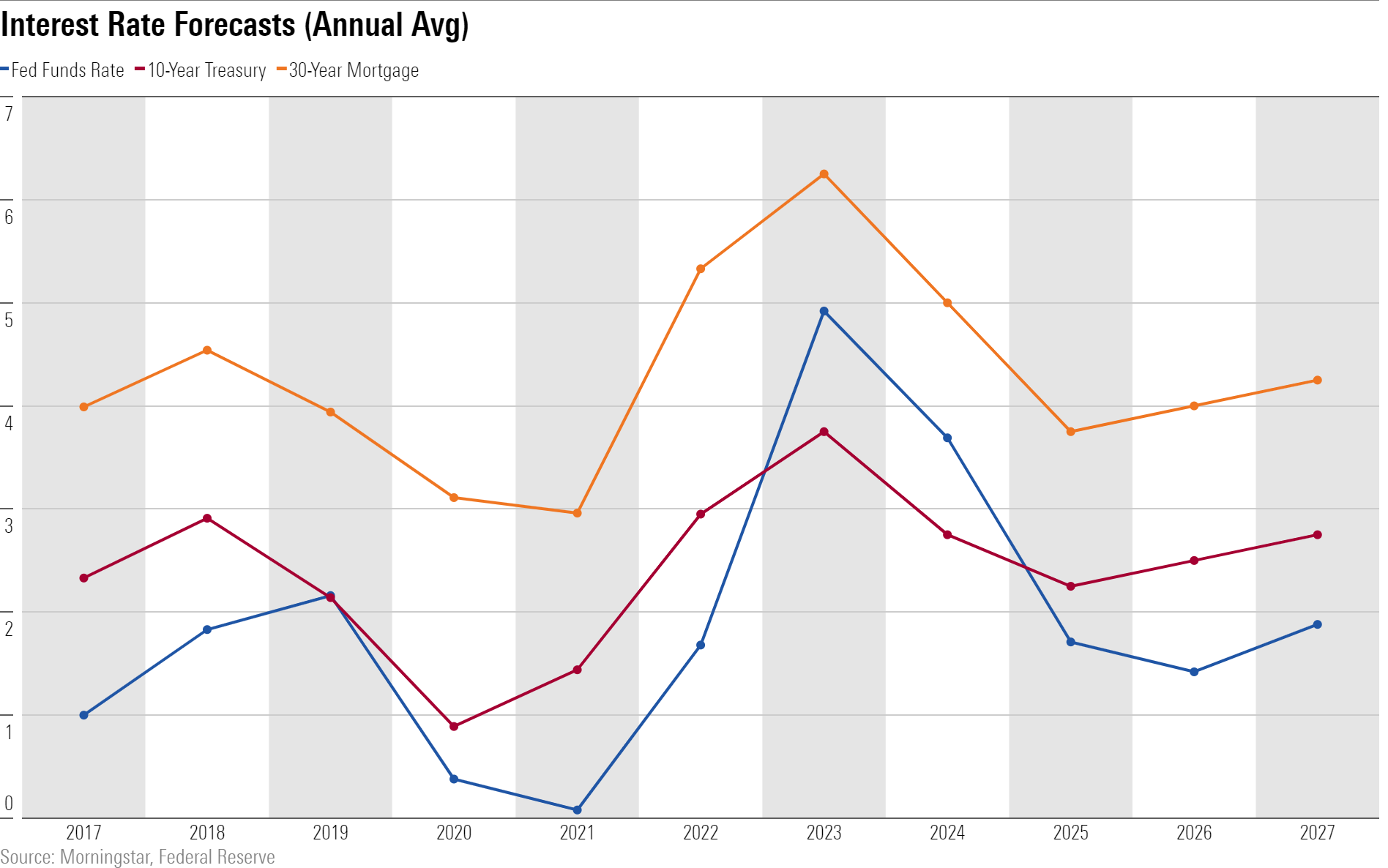

Interest rates have soared over the past year as expectations of monetary policy tightening have built up and begun to play out.

Since our last update, we’ve hiked our near-term forecast—we expect a federal-funds rate of 4.92% and a 10-year Treasury yield of 3.75% for 2023 (full-year average).

However, we still think rates will soon reach their top and expect the US Federal Reserve to start cutting interest rates aggressively starting around the end of 2023 as inflation normalises and the need to shore up GDP growth becomes paramount.

Bond markets still imply a too-restrictive path for monetary policy, with the five-year Treasury yield around 130 basis points higher than appropriate, given our expected path for the federal-funds rate.

Lower interest rates will be needed to avert an even more severe downturn in the housing markets than is already likely to occur.

For now, the economy is weathering the impact of interest-rate hikes better than we anticipated, but we still expect that many lagged effects of rate hikes will weigh on the economy in 2023.

US inflation should return to normal in 2023

A hotter-than-expected economy means that we’ve upped our inflation forecast slightly for 2023 on average, though we still expect inflation to end the year about in line with the Fed’s 2% target.

A combination of easing supply constraints along with Fed tightening is winning the battle against inflation.

After peaking at 6.2% in 2022, we expect an inflation rate of 3.2% in 2023 before it falls substantially for an average of 1.9% over 2023-27.

This puts us at a more optimistic view than consensus, as we think most of the sources of inflation will unwind and aggressive capacity expansion will continue.

We think that many industries that experienced a large spike in prices since the start of the pandemic will experience deflation over the next several years. This includes energy, autos, and other durable goods. Aggressive capacity expansion across many areas could turn widespread shortages into gluts within a few years.

Falling goods price inflation have helped push the core inflation rate to 4.6% annualized in the past three months, down from 8.0% at the start of 2022.

There’s still a long way to go in bringing inflation back to normal, but the fact that inflation has already fallen so far without a recession occurring is very encouraging.

What could happen to the US economy in 2023?

We map out four potential near-term scenarios for the US economy:

1. Soft landing

This is our base case, meaning that we see inflation returning to normal by the end of 2023, even as real GDP growth remains positive in year-over-year terms.

2. Stagflation

This scenario sees a far more unfavorable inflation/growth trade-off. Those in the stagflation camp point to a labor market still at record levels of tightness according to many measures.

However, our view is that labor demand will slow dramatically in 2023 even without a further large drop in GDP growth.

The stagflationists also point to the current deflation in goods prices as being only a temporary factor alleviating high inflation, but we think goods price deflation will last for several years.

Forecasters also disagree on where GDP growth is trending, though we fall somewhere between the two and don’t strongly hold with either point of view.

3. Severe recession

Proponents of this scenario point to long lags in the effects of monetary policy, meaning the roughly 5% trough-to-peak increase in the federal-funds rate (the largest tightening cycle in 40 years) will eventually have a crushing effect on the economy.

The depletion of excess savings also will weigh on consumption soon.

4. Overheating:

This camp points to the seemingly unstoppable momentum of the labor market.

They also note that other than housing, most of the economy has seemed impervious to the effects of rate hikes. This has been aided by the absence of financial distress.