Tailwinds fade from Australia's largest banks

CBA, NAB, WBC and ANZ all traded higher this week on the rotation from growth to value, but analysts are struggling to put together an exciting long-term investment case for Australia's big 4 banks.

Mentioned: BioNTech SE (BNTX), Fidelity Australian Opportunities (19483), ANZ Group Holdings Ltd (ANZ), Commonwealth Bank of Australia (CBA), National Australia Bank Ltd (NAB), Pfizer Inc (PFE), Westpac Banking Corp (WBC)

Investors in Australia's largest banks got some long-awaited relief this week as the sector rebounded off the back of a possible breakthrough in developing a coronavirus vaccine.

ANZ (ASX: ANZ) rose 5.05 per cent to $20.19 on Tuesday, the Commonwealth (ASX: CBA) gained 2.97 per cent to $72.40, NAB (ASX: NAB) climbed 7.59 per cent to $21.26 and Westpac (ASX: WBC) was up 5.18 per cent to $18.68.

Shares in CBA continued to climb another 2.23 per cent on Wednesday after Australia's largest bank reported a 16 per cent fall in quarterly cash earnings, citing ongoing pressure on margins due to historic low interest rates.

"[CBA's] earnings are beginning to recover from second-half fiscal 2020 profits, which were smashed by large coronavirus-related loan loss provisions of AUD 1.5 billion," Morningstar analysts Nathan Zaia says.

Analysts warn however that the structural growth Australia's largest banks have relied upon for decades has largely played out.

"Banks were growth stocks for a couple decades because we went through the one-off gearing up of Australian households – but that can't be repeated," Fidelity International portfolio manager Kate Howitt told the Morningstar Individual Investor Conference in late-October, describing banks as market chameleons – constantly changing their spots and stripes.

"I know the Reserve Bank and the government want to have low lending rates and get people out there borrowing, but I don't think there's that much demand from households to really go out there and take on a huge amount more leverage in a period of so much uncertainty.

"That broader tailwind has probably played out and now the banks have to go through the hard slog of trying to earn a margin when they're much closer to the lower bound of interest rates."

Howitt, who oversees the Bronze-rated Fidelity Australian Opportunities fund, explains that when the reference rate is so low, it becomes difficult for banks to achieve a solid interest margin, particularly at a time when they're adding on costs to meet their operational risk and meeting compliance costs.

"There's not much that is providing a tailwind to banks right now, and you still could see more bad debts as we go through the roll-off of the deferral period," she says, adding that the virus downturn has turned the banks into economic cyclicals as their earnings crater beyond the fall in GDP.

"I find it really difficult to put together an exciting investment case for banks."

Pfizer (PFE) and partner BioNTech (BNTX) reported favourable phase 3 data on covid-19 vaccine BNT162b2 on Tuesday, with an efficacy rate of over 90 per cent and no major safety issues observed at an interim analysis. Morningstar analysts believe the regulatory agencies are likely to authorise it for emergency use in late 2020, followed by full approval in 2021 pending supportive final data.

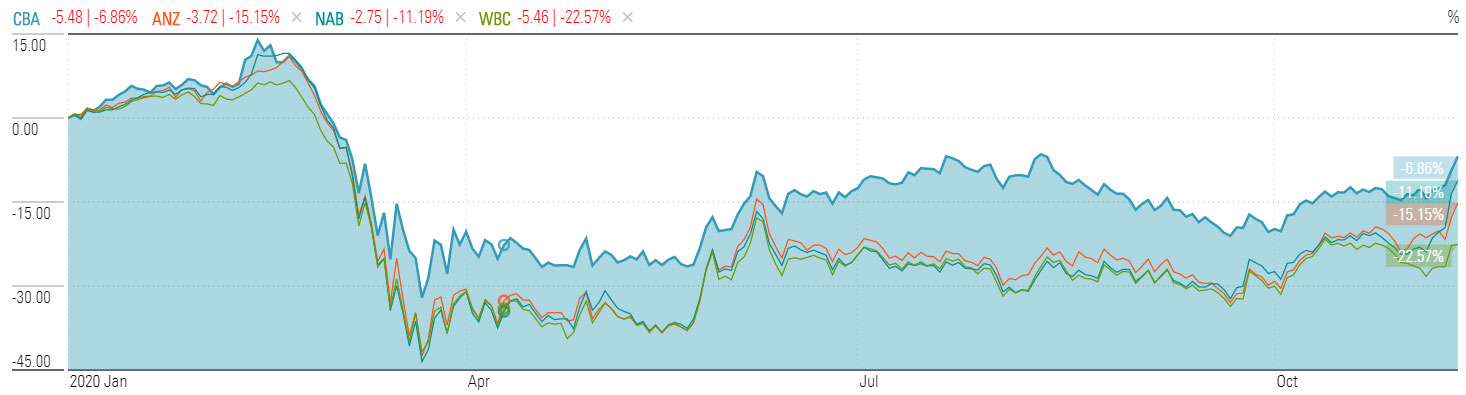

Despite the boost, the big four banks are still trading below their pre-covid levels. Year-to-date, CBA is down around 7 per cent, ANZ is down 15 per cent, NAB down 11 per cent. WBC has been hit the hardest, down 22 per cent.

Big 4 banks, price chart, YTD

Source: Morningstar Direct

Cost savings through digitisation

Investors Mutual investment director Anton Tagliagerro agreed with Howitt, cautioning investors against large positions in the big four. He adds that the bank's capacity to extract high fees has also fallen since the banking royal commission threw a spotlight on the industry.

The only positives for the banks in the covid-crisis, he says, is the acceleration in digitalisation, leading to future cost savings.

"Covid has forced a lot of people to use online banking who otherwise wouldn't, and allowed banks to close branches," he says.

Morningstar head of equity research Peter Warnes is also lukewarm on the sector, citing declining interest rates as a drag on the net interest margin.

"Despite the fact that they're paying you the depositor nothing, the competitive pressure is downward also on the rate they can charge," he says.

Warnes says banks are in their infancy of digitisation but agrees that's where the tailwinds will come from.

There are still opportunities in the sector. WBC is trading at a sizeable discount to Morningstar analyst's $25 fair value estimate. CBA is currently trading within a range analysts consider fairly valued, while ANZ is undervalued at a 19 per cent discount and NAB is undervalued at a 15 per cent discount.

Opportunites remain

Banking analyst Zaia acknowledged the reputational risks hanging over Australia's second largest bank stemming from customer remediation costs and the likelihood of a hefty penalty due to breaches of anti-money-laundering laws. He also assumes bad debt will rise despite government's best efforts to stimulate the economy. But he says the market has overreacted to the potential downsides.

"Westpac remains one of the largest mortgage and business lenders in Australia and New Zealand, benefiting from 70 per cent of funding from low-cost and sticky customer deposits," he says.

"The Reserve Bank of Australia lowering the cash rate to 0.25 per cent has put further pressure on margins in the short term, but nonbank lenders reliant on wholesale funding markets and securitisation markets may well find tighter availability and high costs of funding in more uncertain economic conditions.

"Westpac is also among the world's most cost-efficient banks with little sign of stress in credit quality in recent years.

"All these positives underpin our confidence in solid returns on equity over the long term."