Steel, water and iron ore lay a minefield for Aussie resources

A new Morningstar report examines how BHP, Rio and Fortescue handle environmental, social and governance obstacles.

When it comes to ESG risk, Australia’s mining majors, BHP, Rio Tinto and Fortescue Metals Group, face exposure on all fronts of the environmental, social and governance spectrum. Carbon emissions, high water use, land disturbance, worker strikes, and community backlash: the list of risks is meaningful.

Many of these risks, however, are already factored into valuations, says Morningstar’s Mat Hodge in a special report this week. Take water dependency, for instance. BHP and Rio Tinto face water use risk in building their Escondida copper mine in northern Chile, home to the driest desert on earth. But they manage this risk by building desalination plants, which means seawater is now used instead of groundwater.

Similarly, in an industry with a high level of unionisation, strikes are common and can hinder production levels, but they conversely provide a benefit to price if supply is tighter than it otherwise would have been. And of course, the tailings dam disasters in Brazil have forced miners to improve construction standards.

Of the three miners, Fortescue carries the most ESG risk, chiefly because of the high emissions from steelmaking. “Fortescue produces a materially lower grade iron ore which requires more energy to produce the same amount of steel,” Hodge says.

There is a push to “decarbonise” steelmaking, but it’s unclear who’s leading the charge. And the decarbonisation effort itself will require infrastructure, which requires steel. While this is being figured out, demand remains high: the iron ore price rose on Thursday, buoyed by data showing a record monthly output of crude steel and as China said it sees room for further growth in demand.

“The shift to a lower carbon economy is also expected to impact demand for certain products,” Hodge says. “Currently, there are no alternatives to steel, a commodity that is necessary to build infrastructure required by decarbonisation. This leaves the miners' crown jewel, iron ore, and metallurgical coal somewhat protected from this headwind. Demand for steel is not particularly price sensitive. Likewise, BHP and Rio could benefit from stronger demand for copper and nickel catalysed by electric vehicles and green energy generation.”

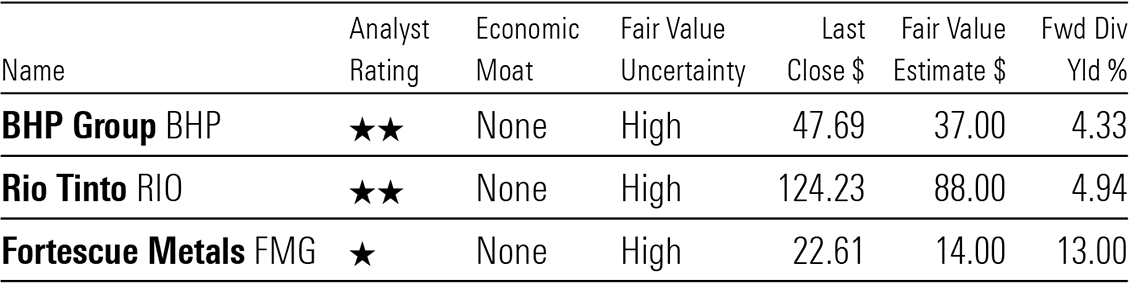

Morningstar valuations for Australia’s major miners

Source: Morningstar Direct; data as of 18 June 2021

In Firstlinks this week, Graham Hand looks at why fund managers and financial advisers alike are overweight equities despite the twin risk of inflation and interest rate rises.

Hand also hears from Damien Klassen, head of investments at Nucleus Wealth, who argues that the investments that might protect a portfolio from inflation have already had their run and current high inflation is supply-chain based and temporary.

Emma Rapaport weighs the pros and cons of active ETFs. Accessibility, price transparency and no ongoing platform fees are some of the advantages over conventional managed funds.

Rapaport also reports on the gender imbalance in the upper echelons of Australia’s investment management industry. Despite some progress, senior roles remain male-dominated.

IPOs are gaining momentum with the commodity boom. Prices are high and investors are opening their wallets in search of the next big success story, writes Nicki Bourlioufas.

Speaking of IPOs, Morningstar initiates coverage on the liquor and hotel company Endeavour Group, granting it a wide-moat rating. We speak to Johannes Faul on whether the demerger from Woolworths will pay dividends.

Lazard Asset Management's Warryn Robertson explains how companies in the Global Equity Franchise fund have adjusted to covid and assesses the threat of rising inflation.

The outlook for dividends from resources and financial services sector stocks is showing a rebound towards previous levels, according to Ausbil.

Liam Shorte from Verante Financial Planning provides the ultimate end-of-financial-year checklist for SMSFs.

Do you resort to social media for financial advice? Following their advice blindly is not a solid strategy, argues Morningstar UK’s Sunniva Kolostyak.

What if you missed the dip? In his chart of the week, Lewis Jackson shows that an investor who bought shares just before Lehman went bankrupt would still be up 145 per cent today.

And finally, in Your Money Weekly, Peter Warnes explains why investors need to plan as the global liquidity king tide ebbs. “The water is muddied by excess liquidity and central bank purchases are putting downward pressure on yields,” writes Warnes.

We trust you enjoy the content.