The trillion-dollar club: Are these mega-sized stocks still buys?

The biggest stocks got bigger this year, breaking multi-trillion-dollar milestones.

As a handful of the largest stocks led the bull market in 2025, some of those mega-sized names have soared to sky-high market capitalizations, including Nvidia NVDA, Apple AAPL, and Taiwan Semiconductor Manufacturing TSM.

A total of 10 stocks are set to end the year in the “trillion-dollar club,” with market caps of over $1 trillion each. In the process, some have outrun their valuations and are trading at levels that Morningstar analysts think are expensive. But a number of these giant companies have also seen their business prospects grow substantially, leaving them undervalued.

In October, Nvidia became the first stock to surpass a market capitalization of $4 trillion, propelled by massive demand for its semiconductor chips from artificial intelligence technologies. That same month, Apple, having rebounded from a swoon in the first half of the year, also went above $4 trillion, thanks mainly to an improved outlook for iPhone sales. (Back in 2018, Apple became the first public company worth more than $1 trillion.) Alphabet GOOG and Microsoft MSFT are close behind, heading toward $4 trillion.

The market also welcomed chip manufacturing giant Taiwan Semiconductor to the trillion-dollar club this year, as the company benefited from the same demand for semiconductor chips as Nvidia. Morningstar analyst Phelix Lee says, “We expect cloud service providers and other customers to ramp up AI spending.”

There are now ten stocks valued north of $1 trillion, with Eli Lily LLY having briefly been the 11th in November, on the back of strong demand for its weight loss drugs. It is now back to trading just below that mark.

Focus on valuations, not size

While the massive scale of these stocks is notable, investors looking to put money to work need to pay attention to how the stocks are priced relative to their fundamental outlooks. From this perspective, Morningstar analysts see a mixed bag. Of the 10 stocks with market caps above $1 trillion, four trade at a discount to their estimated fair value, four trade close to those estimates, and two trade at a premium.

When those valuations are translated into Morningstar Ratings, four of the stocks are rated 4 stars, meaning our analysts believe they’re undervalued. Four are considered fairly valued with 3-star ratings, and two are overvalued at 2 stars.

Trillion-dollar stocks

Here’s a closer look at what Morningstar analysts have had to say about the each of the stocks with trillion-dollar-plus market caps:

Alphabet

- Morningstar Rating: ★★★

- Fair Value Estimate: $340.00

- Morningstar Uncertainty Rating: Medium

“We have reiterated our confidence in Alphabet’s full-stack AI strategy multiple times over the last year, with the firm being the only AI player with leading-edge solutions all the way from infrastructure, TPUs, and Google Cloud, to consumer distribution, Search, and Gemini.

“We ... continue to view the firm as exceptionally well positioned in everything AI.”

—Malik Ahmed Khan

Amazon

- Morningstar Rating: ★★★★

- Fair Value Estimate: $260.00

- Morningstar Uncertainty Rating: Medium

“AWS was strong [in the third quarter] as growth accelerated to 20% year over year, a pace that CEO Andy Jassy thinks can continue for ‘a while.’ As such, the firm is capacity-constrained and plans to accelerate expansion based on demand signals. Demand is very strong for artificial intelligence, but core workloads also performed well.

“Amazon detailed innovation within the AWS portfolio that is helping attract new customers. Anthropic’s use of Trainium 2, with its compelling price performance and the fact that Trainium 3 will arrive by the end of 2025, could extend AWS’ surging growth through next year.”

—Dan Romanoff

Apple

- Morningstar Rating: ★★

- Fair Value Estimate: $240.00

- Morningstar Uncertainty Rating: Medium

“We’re impressed by growth and profitability despite a slow artificial intelligence feature rollout, tariffs, and China headwinds. Still, we find the market’s valuation challenging.”

—William Kerwin

Berkshire Hathaway

- Morningstar Rating: ★★★

- Fair Value Estimate: $765000.00

- Morningstar Uncertainty Rating: Low

“We’ve increased our fair value estimate to $765,000 per Class A share from $730,500 to reflect changes in our forecasts for the company’s operating businesses and insurance investment portfolio since our last update. Our fair value estimate is equivalent to 1.53 and 1.38 times our estimates for Berkshire’s book value per share, respectively, at the end of 2025 and 2026. For some perspective, during the past five years, the shares have traded at an average of 1.49 times trailing calendar year-end book value per share.”

—Greggory Warren

Broadcom

- Morningstar Rating: ★★★

- Fair Value Estimate: $365.00

- Morningstar Uncertainty Rating: High

“We have raised our fair value estimate for wide-moat Broadcom to $365 per share from $325 as we increase our AI revenue estimates to account for the deal. We expect incremental accelerator and networking revenue to drive stunning growth through 2029. The shares look fairly valued.

“Broadcom had guided to $10 billion in new revenue in fiscal 2026 from the fourth customer and hinted at an acceleration in fiscal 2027, but we now expect even stronger growth. We expect [the company’s] AI revenue to double to $40 billion in fiscal 2026 and nearly double again in fiscal 2027.

“We see [the stronger growth in AI revenue] as a long-term growth runway for Broadcom. We expect existing customers to expand orders of custom compute and networking chips as they build bigger models. We also expect more customers to come onboard, augmenting Broadcom’s sales.”

—William Kerwin

Meta Platforms

- Morningstar Rating: ★★★★

- Fair Value Estimate: $850.00

- Morningstar Uncertainty Rating: High

“[In light of Meta’s third-quarter earnings results] We maintain our $850 fair value estimate for wide-moat Meta, with the firm’s strong performance offset by the higher-than-expected capital and operating expenditures commentary for 2026.

“We understand investor fears around investments in AI. After a scarring Reality Labs misallocation of capital, investors are again doubting Meta’s capital allocation strategy for AI. We are not as pessimistic.”

—Malik Ahmed Khan

Microsoft

- Morningstar Rating: ★★★★

- Fair Value Estimate: $600.00

- Morningstar Uncertainty Rating: Medium

“We maintain our fair value estimate for wide-moat Microsoft at $600 per share. We raised our Azure growth by about 100 basis points annually, which was offset by higher capital expenditures within our model. The stock remains one of our top picks.”

—Dan Romanoff

Nvidia

- Morningstar Rating: ★★★★

- Fair Value Estimate: $240.00

- Morningstar Uncertainty Rating: Very High

“We still see Nvidia shares as undervalued and view recent AI bubble chatter as a buying opportunity. Longer-term concerns about AI funding and energy buildouts are valid in the medium to long term, but 2026 is shaping up to be another stellar AI year, in our view.”

—Brian Colello

Taiwan Semiconductor Manufacturing

- Morningstar Rating: ★★★

- Fair Value Estimate: $310.00

- Morningstar Uncertainty Rating: Medium

“Strong investments in artificial intelligence and a rebound in mature process nodes support TSMC’s higher full-year outlook. We expect cloud service providers and other customers to ramp up AI spending, which eases TSMC’s exposure to Nvidia.

“Shares appear cheap, as we expect demand from AI inference will be long-lasting, potentially more than training AI models.”

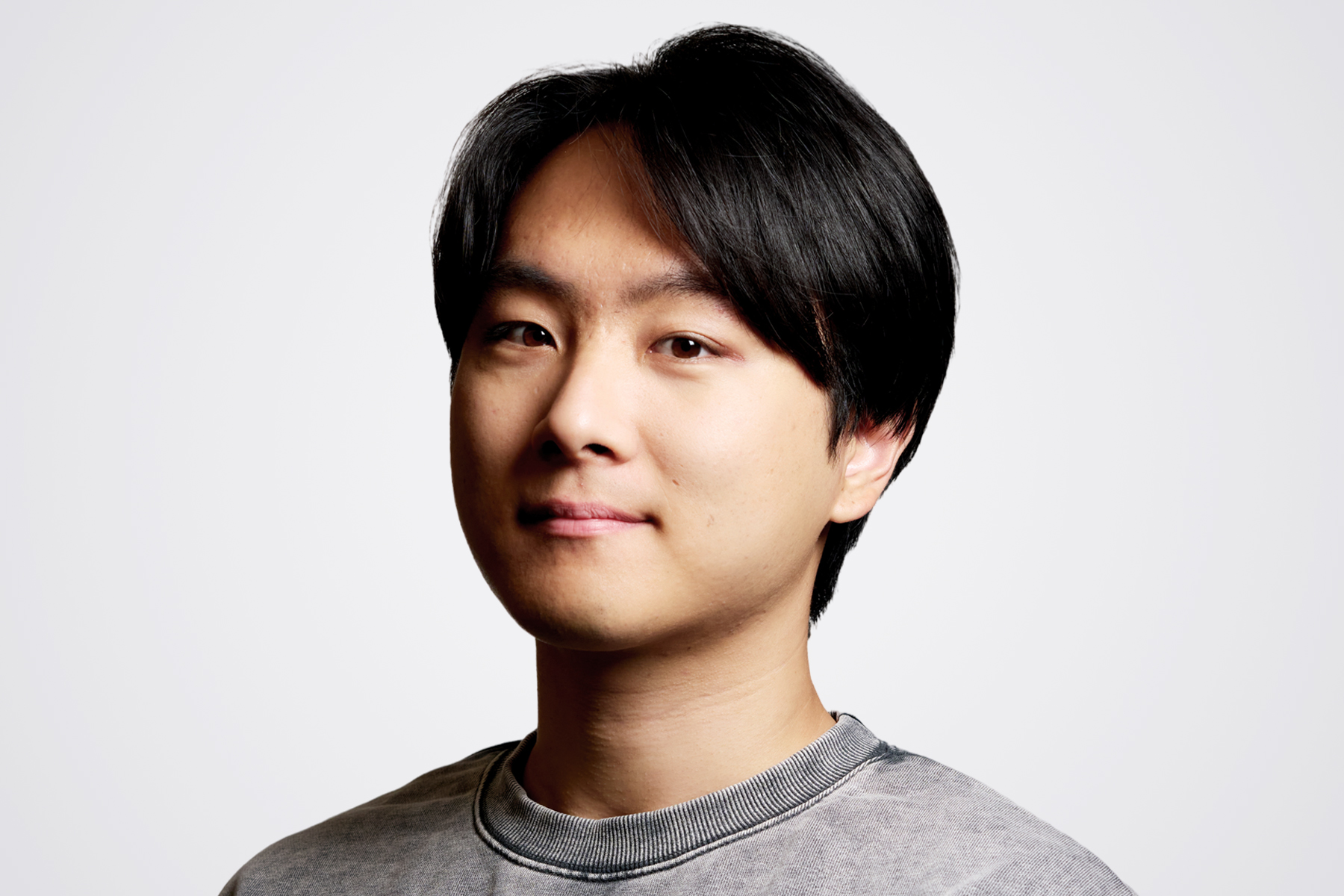

—Phelix Lee

Tesla

- Morningstar Rating: ★★

- Fair Value Estimate: $300.00

- Morningstar Uncertainty Rating: Very High

“We view Tesla shares as overvalued currently, trading around 50% above our fair value estimate and in 2-star territory.

“The stock continues to price in an optimistic scenario for success in Tesla’s robotaxi business. While management is guiding to a full rollout next year, we think the product will still be in testing; we point to 2028 for the full rollout, with no safety drivers and limited geofencing.”

—Seth Goldstein